Hi David,

On Wednesday, Donald Trump and three of the world’s prominent tech bosses announced a joint venture to fund AI infrastructure worth billions of dollars, in a bid to strengthen US development of the emerging technology. OpenAI, SoftBank, Oracle and other partners will start the venture, named Stargate, to build the infrastructure. The companies are committing $US100 billion to it and plan to invest up to $US500 billion over the next four years, not numbers for small players.

- Interestingly, in our business operations at MM, we use two of the companies you mentioned, HUBSPOT (HUBS US) which is the backend of our subscription management and email system, and Atlassian (TEAM US) which is used for collaboration – both companies are big with market caps of US$37bn & US$68bn respectively, broadly the same as ANZ & NAB.

This is an excellent question to consider more broadly, and one we have often pondered given the concept of ‘winner takes all in tech’. From a general sense, we think it’s much safer to stay with the big guys, if AI proves to be as big as we think it will be, big companies involved in the space are in the box seat to take full advantage.

However, we do think many companies are now being termed AI stocks, just because they use AI. In terms of HUB and TEAM, they are companies using and developing AI to improve their business, whereas Nvidia (NVDA US) provide the chips that power it – a true AI company. OpenAI is another, which has developed ChatGPT, a language model they’ve created, designed to understand and generate human-like text, which other businesses will then leverage off – again, a true AI company where Microsoft (MSFT US) has a significant stake.

If smaller companies are doing very specific/niche things, the big guys will likely just buy them, so plenty of money could be made in very specific, unique areas of the AI revolution, but we would stress that specialist knowledge in these areas is more crucial.

- At this point, we don’t think we possess the granular knowledge that is required to support investments in the (true) smaller AI companies and given how capital intensive and competitive this area is becoming, having this knowledge is key.

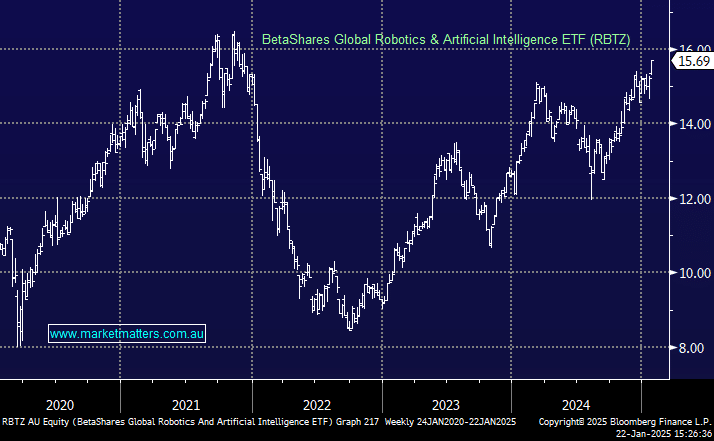

We are very bullish the AI thematic over the coming decade and for investors uncertain which individual companies will lead the pack, ETFs are an option, with the locally traded RBTZ ETF one such idea. The ETF currently holds ~13% in Nvidia but this will evolve as other companies come to the fore in the space.