Ageing Population related companies

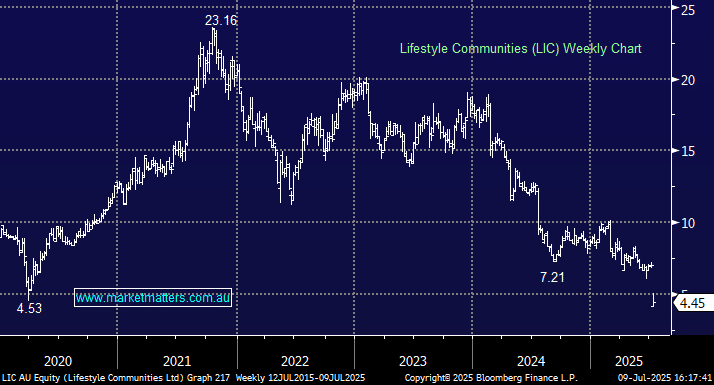

Hi MM, Probably a question for Saturday's Q&A report - a) Do you think you can do an analysis or a report focusing on an ageing population? Would be interesting to view your comments on ageing or population related stocks like EGH, LIC and PFP. b) What is your view on the newly listed company - Gemlife and how does that compare to its peers like INA & LIC ? c) With INA, can see from your website, its EPS is 0.03, but it is forecasted to have 0.30? that is 10x, is that right? what is the basis for a 10x increase? d) And lastly, what is MM's favourite of the several ageing population related companies in the ASX? Thanks again, Jacky