Hi Malcolm,

This sounds like wonderful technology that could revolutionise the building industry. The robot is truck-mounted (i.e. mobile), with a boom reach of ~32 m (105 ft), capable of handling relatively large masonry blocks (600 × 400 × 300 mm) and laying blocks at up to ~360 blocks/hour in trials. They ‘talk it up’ in terms of building a house in a day, however, FBR has not shown a credible path to large-scale commercial adoption or mass deployment. It is still largely at the pilot / demonstration stage.

They had an agreement with CRH (for up to 10 houses, and options for 20 Hadrian units) and it looks like this program did not fully expand; the option period expired without full exercise which implies it may not have worked as well as they said it would. Without having an in depth knowldge of their capability, adoption by builders would be the key for us, and we’re yet to see commercial contracts being executed – which is what we would be looking. The financials are very weak; revenue is minimal, losses are large, and cash burn is significant.

The company has gone through repeated fundraising, and has issued many new shares, most recently a $12.5mn placement at 0.038c, a 20% discount at the time, a huge raise for a $26mn business.

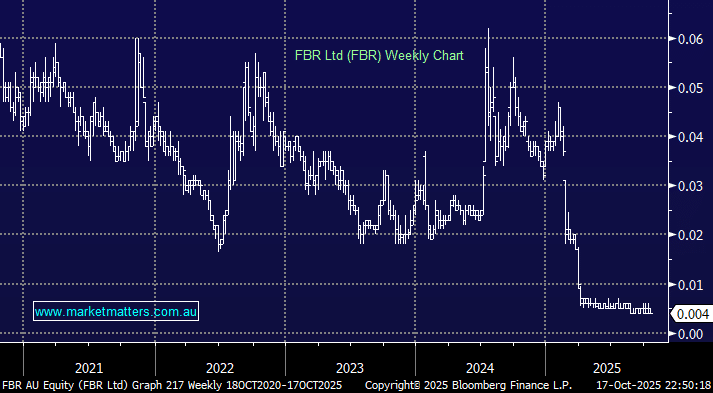

The story reads well but the price action tells us brickies are safe for now, we would rather consider the stock into strength when we some commercial traction in the adoption of its technology.