Abb and NSR

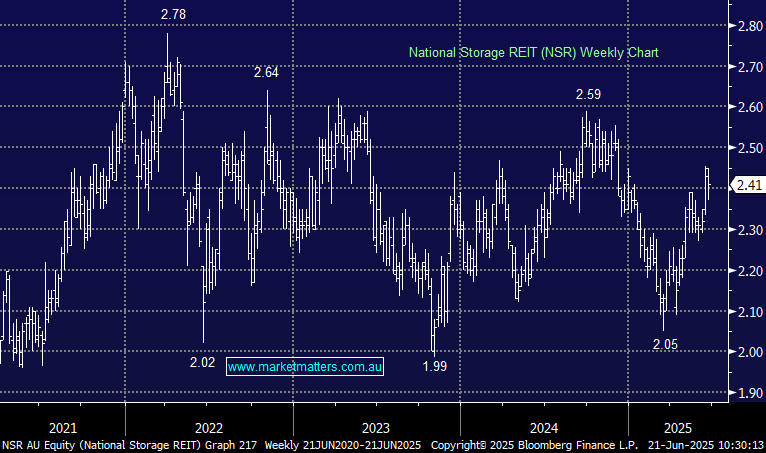

Hi guys, Thanks for all your hard work. I love MM. I’m just curious about your current thoughts on some of your current holdings. ABB: I’m curious as to why MM has remained believers in ABB and are currently still sticking with it. The share price hasn’t really increased since MM first purchased the stock around $5 in November 2021. I know there has been trimming and additional buying since then. You guys are usually quite ruthless when it comes to cutting a loss or moving on from a stock when its not working - what is it about ABB that has it being treated a little differently perhaps? Is it about having exposure to that sector? With profit increasing, are you waiting for the share price to catch up to the growth? NSR: Similarly with NSR, its been quite range bound a for a few years now, trading between mid to high $2 to low $2. How come you are sticking with it? is it again, about having exposure to the sector?