Hi Lana,

Two very different but interesting stocks at present:

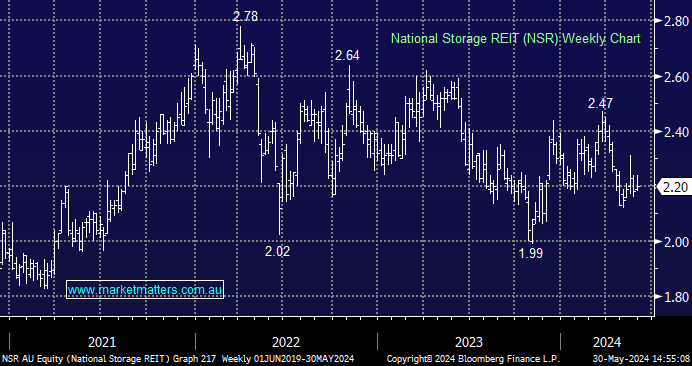

National Storage (NSR) – we do still like NSR as a more calming component of the MM Active Growth Portfolio. Not all portfolio positions can have a Beta of say Paladin (PDN) or Sandfire Resources (SFR), they look great when they move your way but as we all know that’s not always the case. Coming back to NSR which is indeed being weighed down by rising bond yields but we are firm believers in the long term macro trend of higher density living which combined with peoples love of “stuff” is a bullish for NSR.

a2 Milk (A2M) – After a tough few years A2M has surged over 60% in 2024, not bad when the markets actually slightly lower. We do believe the company has turned the corner but we don’t like the risk/reward around $7 especially after their milk sales goal has been delayed by Chinas birth rate – it screens expensively on 32x with these uncertainties surfacing. We would be more interested nearer $6.