Hi David,

I’m sure plenty of punters who are buying these stocks have very little knowledge of what they do outside of their names! Two of them have been on the volatile rare earth’s roller coaster ride while the other two have been choppy/volatile but not exciting. None of the four generate revenue let along make a profit.

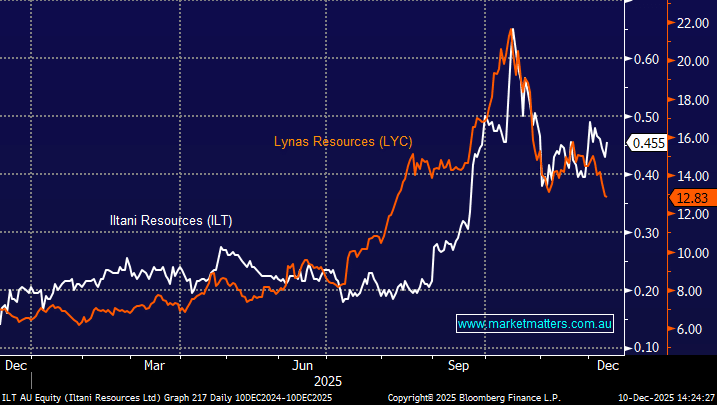

Iltani Resources Ltd (ILT) is a $33mn explorer & developer whose focus is on discovering and developing precious metals, base metals, and “critical minerals” — including silver, lead, zinc, tin, indium, copper, gold, and antimony. Based on their burn rate and its cash reserve, the company appears to have a cash runway of ~10 months as of mid-2025 – it raised $2.97mn earlier in the year (before costs), issuing a total of 12.8 million new shares at $0.215 each.

- We prefer Lynas (LYC) in the rare earths space where we see perceived “real value” while also basically tripling and halving in 2025 to satisfy the adrenalin traders.

Lode Resources Ltd (LDR) is a $30mn explorer whose flagship asset is the Montezuma Antimony Project on Tasmania’s West Coast — where Lode holds 100% ownership. Similarly, it has a cash runway of roughly 12–14 months at current burn rates.

- It generally trades less volume than ILT but again follows the Rare Earths sector closely even though its pre-revenue.

Rapid Critical Metals Ltd (RCM) is a $67mn junior explorer focused on developing high-grade silver and critical-mineral projects in Australia and Canada, targeting metals like silver, gallium, and germanium for future resource growth.

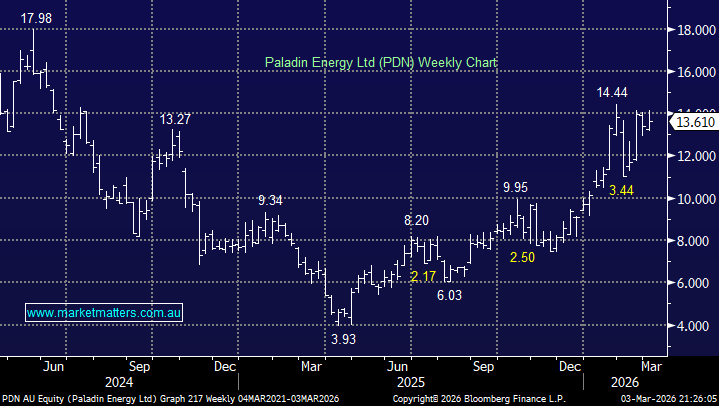

- Technically and fundamentally, we see no reason to buy RCM, it’s still over 95% below its 2022 highs.

Australian Gold & Copper Ltd (AGC) is a $57mn junior explorer chasing gold (and associated base-metal) riches across a suite of exploration licences in the Lachlan Fold Belt, NSW.

In May last year, AGC announced “outstanding” drill results from its Achilles project the stock popped 600% to 60c before retreating back towards 20c where it’s trading today – not unusual in the small end of town.

The very junior resource space is not really our area of expertise, and nothing excites us amongst these 4 stocks, but one or more will probably pop higher at some time in the next year. If we “go out on a limb” we would pick AGC.