QBE – the vibe not as bad as the raw numbers suggest (QBE, IFL, OSH, RMD)

WHAT MATTERED TODAY

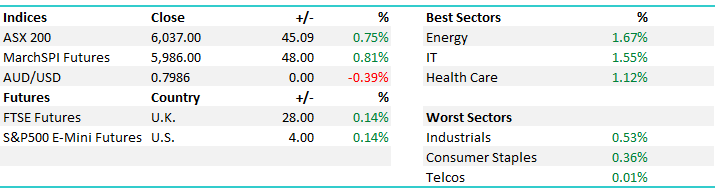

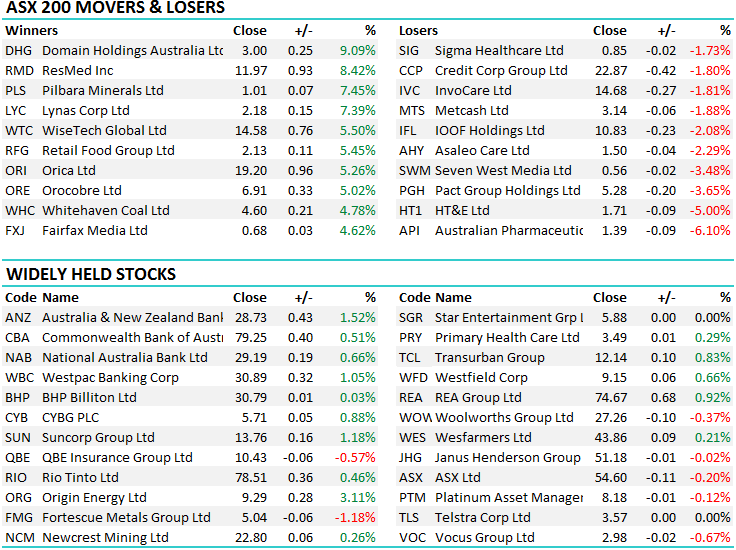

A good day for Aussie stocks rebounding from a 5 day sell off with some broad based buying across the index. Growth related stocks did best following the IMF upgrade to global growth expectations while the US got their act together over the Govt shutdown.

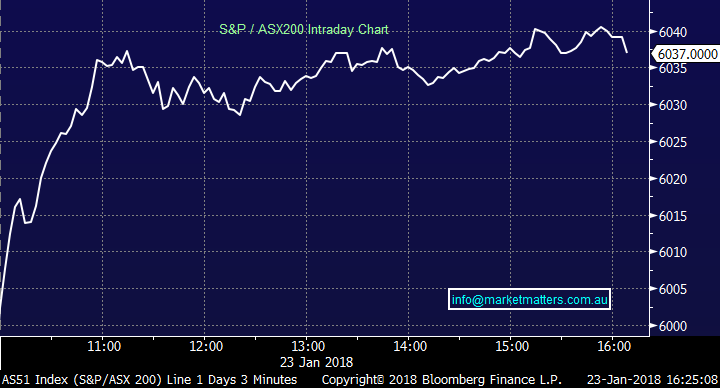

The S&P/ASX 200 index advanced 45 points, or 0.8 per cent, to 6037, while the broader All Ordinaries reached 6151, a 44point, or 0.7 per cent gain. The Australian dollar weakened to US79.88. The big banks picked up on the upbeat mood, with ANZ gaining 1.5 per cent to $28.73, Westpac rising 1.1 per cent to $30.89, CBA up 0.5 per cent to $79.25 and NAB up 0.7 per cent at $29.19. Domain (DMG) was upgraded at UBS after yesterday’s weakness and rallied hard while they also put an upgrade through for Treasury Wines (TWE) with a PT of $17.30 . They reckon the Asian growth story is just beginning. The stock added +4%. Elsewhere, Morgan Staneley upgraded Orica (ORI) and that stock rallied while Bells put a downbeat call out on IOOF (IFL), which I cover more below.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

CATCHING OUR EYE

1. QBE Insurance $10.43 / -0.57%: QBE hit hard on open this morning and traded down below $10 in early trade following a negative update from the company in terms of their 2017 numbers, however the weakness threw up a buying opportunity following the conference call and the stock started to find some love – trading +5.78% up from the daily lows – a good performance given the actual weakness of the numbers presented.

The high notes were; QBE's net loss for the 2017 calendar year will hit $US1.2 billion due to a series of natural disasters, an increase in reserves, a write down due to the changes in US tax law (their accumulated losses are worth less) and a write down of goodwill ($700m) from their Nth American operations. Basically, the bulk of these issues are one off, non-cash items so they appear big but the impact simply isn’t that significant. Pat Regan is the new CEO and has done a comprehensive review of the business, and clearly the move today looks very much like he’s clearing the decks. Arguably, it could have been a lot worse and when questioned on the conference call, Regan outlined that he omitted some of the elements that have the potential to positively impact 2018/19 performance – or in other words, he’s presented a set of very conservative numbers here.

QBE has clearly gone through a tough period with more reviews than a Kyrgios match on Rod Laver Arena, and Regan’s was simply the last in a long line – however it felt to me that the mkt simply thought – is that all!! Is that as bad as it gets?

Regan stressed the important for QBE to start meeting / exceeding guidance and the easiest way to do that is to be more conservative in terms of said guidance. He seems very focussed on simplifying the business, getting better results from underwriting, and improving the outcomes of existing operations rather than getting growth in new ones. I got off the call wanting to buy the stock, not sell it and it seems that perception was a common trait around the mkt.

We already own the stock with a 7% weighting in the Growth Portfolio – the stock owes us $10.52 however the frustration for us was our reluctance to take some off a big position above $13 when it was there. Still, I simply get the feeling that the QBE of the future will do lot better than the QBE of the recent past. Whatever the case, todays trade from the lows was strong. We own QBE

QBE Insurance Daily Chart

I also provided a quick update around lunchtime in our Direct From The Desk segment.

2. Resmed (RMD) $11.97 / +8.42%: A cracking day for the healthcare stock on the back of a very good set of interim numbers. They reported 2Q 2018 revenue of $601.3m versus consensus of $581.7m (range $571m-$595m), while earnings per share printed $1 versus 76cps expected by the street. Margins were good / inline with forecasts while they declared a 35c/share dividend. All up a very strong result from RMD and the stock did well on the back of it. We don’t own RMD

Resmed Daily Chart

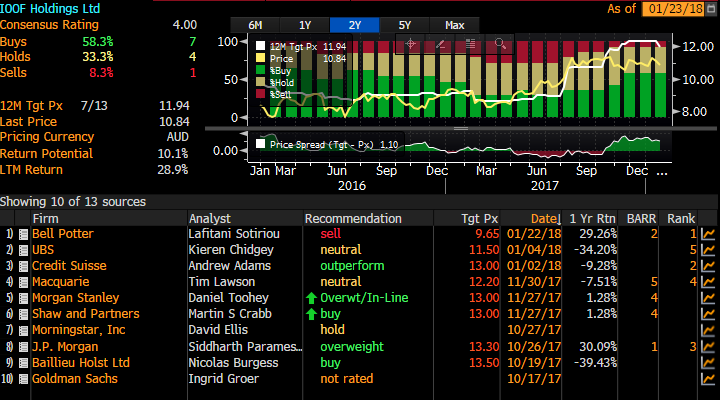

3. IOOF (IFL) $10.83/ -2.08%: Hit today on a broker downgrade from Bells – Laf, the No 1 rated analyst on the stock took a knife to his expectations with a big cut to price target and a SELL. We like those analysts that don’t sit on the fence, make a well researched call that is outside consensus, we certainly take note and today that was the case with IFL. The rationale is around when the earnings benefit of the ANZ Wealth acquisition will occur, and they’ve pushed their expectations out to FY20…as the report suggests,

We argue that part of the reason ANZ Wealth was sold is that the bank was unwilling to make the necessary investment to modernise its offering. Instead, you now have two underinvested wealth businesses about to embark on a major merger.

They downgraded from $11.06 PT to $9.65 with earnings expectations up a tad in FY 18 but down in FY19 & 20. The call is an outlier but worth pondering in our view. We own the stock from around current levels and will be reviewing.

IOOF Daily Chart

4. Oil Search (OSH) $7.69 / -0.39%: Was out with December quarter production numbers today and we saw no surprises in terms of production or revenue. 2017 EPS improvements should filter through reflecting better than expected guidance on costs, exploration and tax rates.

The numbers; 2018 total output seen at 28.5-30.5mmboe vs 2017 total output 30.31mmboe; saw 2017 at top 29-30.5mmboe range. For the Dec. qtr they saw total output of 7.59mmboe, down 4% q/q with 2017 production costs at lower end of $8.50-$9.50/boe range. While we like Oil here, and if our $US70 Oil target becomes reality, OSH will do well, we prefer Woodside (WPL)

Oil Search Daily Chart

OUR CALLS

We got out of Harvey Norman (HVN) today in the MM Income Portfolio, booking a nice 13% profit. We originally targeted $4.60 however from a risk / reward perspective the bulk of our expected gains had been achieved. We’ll cover it more in the Income Report tomorrow.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/01/2017. 5.09PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here