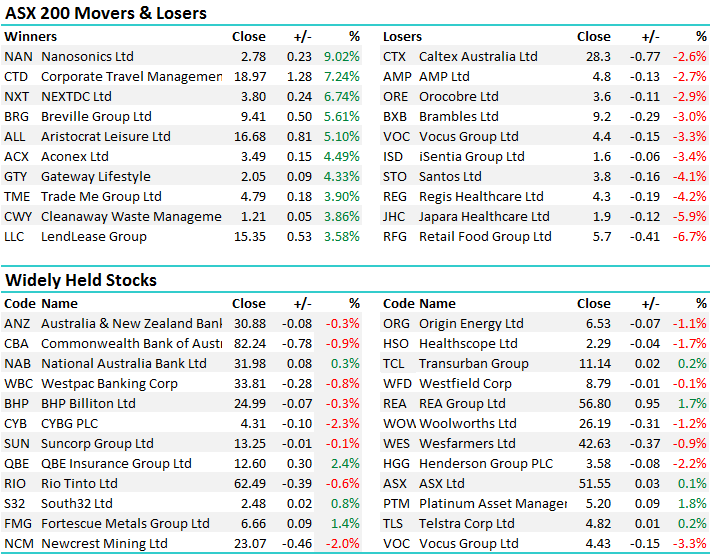

QBE result the standout in otherwise soggy market…

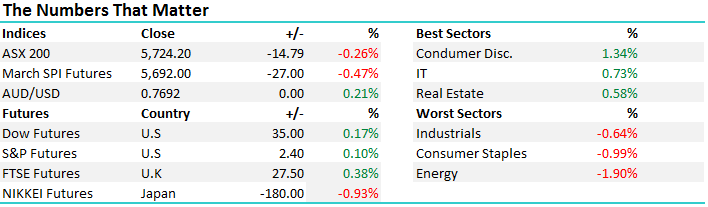

The market opened down a touch but then saw some decent follow through selling pushing the index to a midday low around 5710, a recovery into 2pm then another selloff in the last hour of trade. Iron Ore Futures copped a bid and traded up more than 5% in China at their best and that prompted a decent turnaround for the mining stocks eg (RIO +$1 from their daily lows – FMG up from $6.48 to a $6.66 close ), but it wasn’t enough to get the index up by the end. We had a range today of +/- 33 points, a high of 5743, a low of 5710 and a close of 5724, off -14pts or -0.26%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

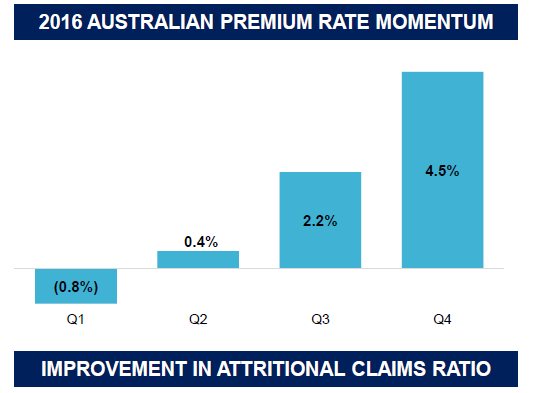

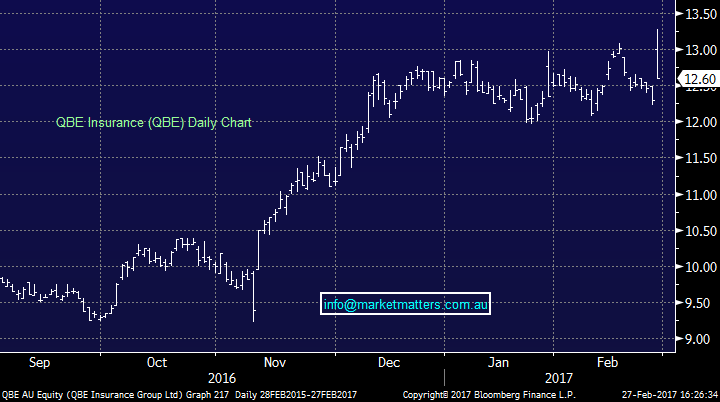

QBE Insurance (QBE); A very good set of full year numbers from QBE this morning and the stock was up sharply in early trade before profit takers came in and the stock drifted back from the highs to close up +2.44% to $12.60. A couple of really strong aspects to the QBE result are worth highlighting. Gross Written Premium was up, Insurance margins were up, Return on Equity was up and Expenses were down. Insurance profit was a 10% beat to consensus, insurance margins, which has been a real problem for QBE in the recent times came in at 9.7% v consensus of 8.4% and importantly we’re seeing good momentum in premiums…a topic we’ve discussed many times and one of the reasons we’re very overweight the sector with both SUN and QBE in our portfolio. Other metrics were very good with a $1bn share buy-back proposed over a 3 year period and the usual positive flows from higher interest rates that will continue to help their investment returns. The AUD trading down to 65c would be the cherry on the cake… We own QBE

QBE Insurance (QBE) Daily Chart

Lend Lease (LLC); Reported 1H17 numbers this morning and on the face of it, they looked very good. A beat on consensus for most metrics with all divisions growing relative to IH16. That said, LLC is a very complicated business and they can easily realise gains from projects earlier than the market had anticipated, thus bringing forward revenue. From experience, we’re reluctant to jump quickly following an LLC earnings result because the devil is always in the detail with this stock. More on this one tomorrow. LLC closed +3.58% at $15.35. We don’t own LLC

Lend Lease (LLC) Daily Chart

We had a fairly busy day in terms of the Market Matters portfolio, selling two holdings, tweaking a number of existing holdings and adding an additional 2 stocks to the portfolio.

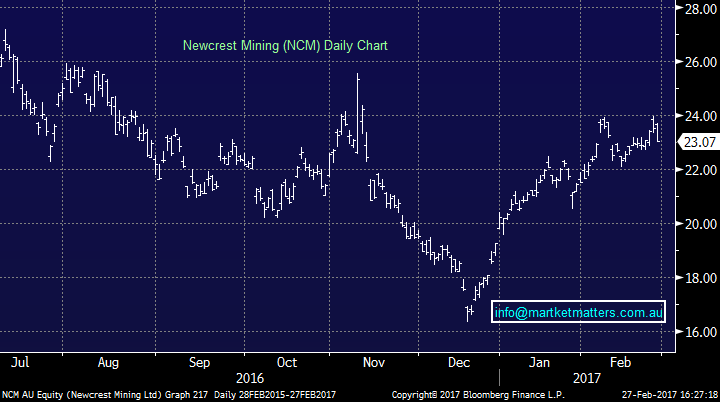

Newcrest Mining (NCM); we sold our 5% position in NCM booking an ~11% profit with the view of buying Evolution (EVN) into expected weakness for Gold in the short term. We remain very keen on Gold for 2017 however the price has run too far in the short term in our view.

Newcrest (NCM) Daily Chart

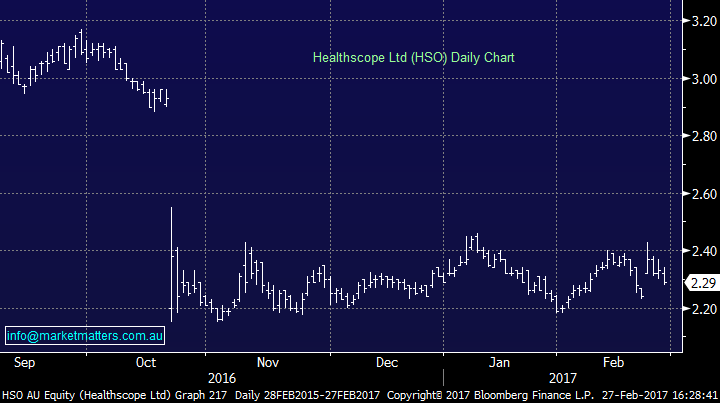

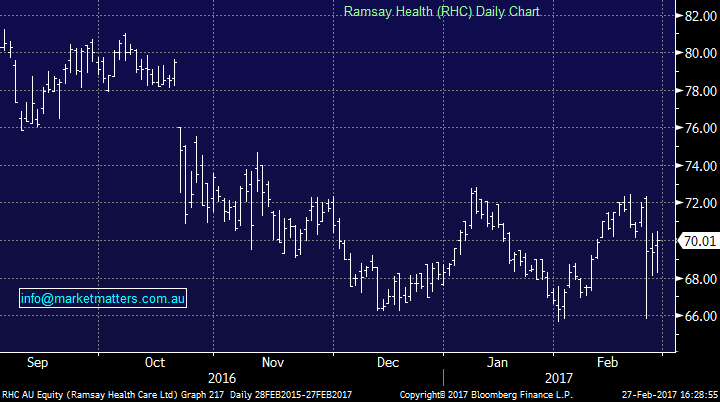

Healthscope (HSO); we sold our 5% position in HSO today for a small loss. We bought HSO into weakness following their ‘downgrade’ earlier in the year after the overreaction by the market. After digging deeper into HSO’s recent result, it seems fairly clear that there is a lack of clarity in terms of hospital demand in Australia over the next 6-12 months. Given we like the longer term drivers for private hospitals we switched 4% into Ramsay. RHC has a higher exposure internationally (as well as locally) and we think RHC will outperform HSO over the next 6 months…

Healthscope (HSO) Daily Chart

Ramsay Healthcare (RHC) Daily Chart

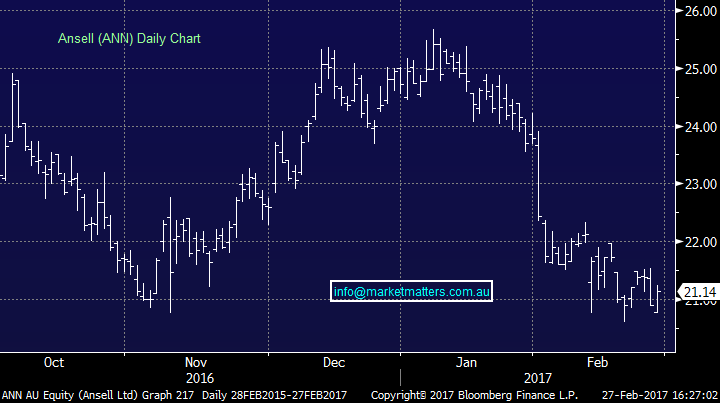

Ansell (ANN); We bought ANN today allocating 4% of the portfolio into the stock. ANN has traded back into our targeted range around $21, a good technical level for ANN after its recent pullback from above $25. This is a good defensive earnings stream and a business we rate highly.

We tweaked two existing positions slightly, with a reduction in Vocus (VOC) by 2.5% to 7.5% and an increase in Platinum Asset Management (PTM) from 5% to 7.5%. Clearly, Vocus has been a thorn for the MM portfolio for some time and we’re pleased with the recent share price performance from the recent low of $3.69 to close today at $4.43. We trimmed our holding a tad above $4.46 by 2.5%. This remains one of our larger positions in the portfolio, however recent history suggests that VOC should be considered a ‘higher risk’ stock and as such, we trimmed to a more realistic weighting relative to this risk level.

We used the capital from VOC to up weight in PTM. Despite PTM reporting a mixed set of results recently, the underlying trends in the business have ticked up (performance / FUM flow etc), they have a high level of cash on the balance sheet, and go ex-dividend on the 1st March for 15c fully franked. PTM closed up +1.76% today to $5.20.

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/02/2017. 6.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here