Production reports dominate the news flow (VCX, STO, OZL, EVN)

WHAT MATTERED TODAY

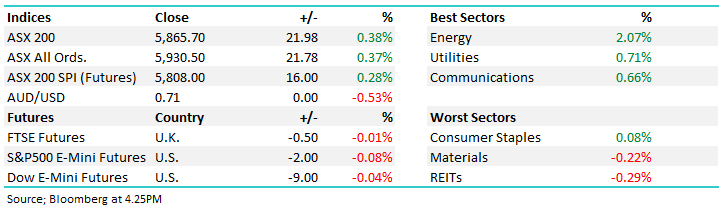

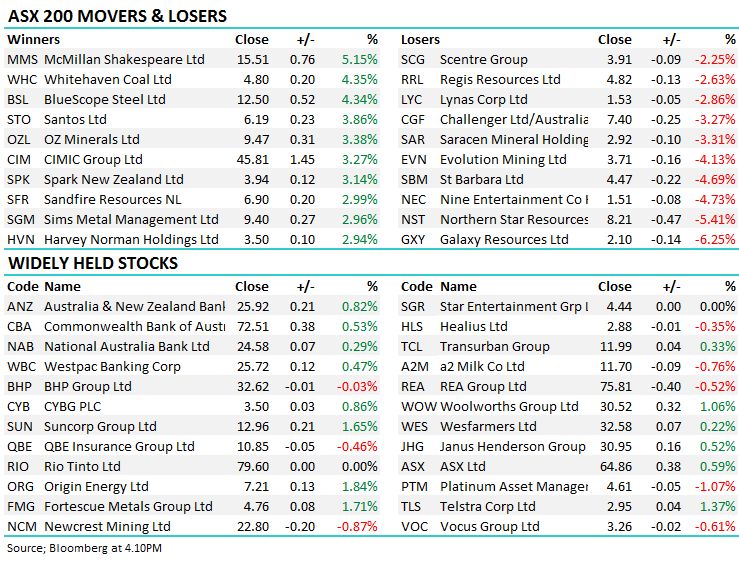

The ASX edged higher with most of the gains coming late in the day, strong buying in the match with light volumes and options expiry playing around with prices - some big lines in the banks went through today ahead of what should be a fairly quite Friday leading into the Australia Day long weekend – remember it’s a Holiday Monday. There was strong buying amongst the Energy stocks today, Santos a standout adding +3.86% on a good production report while Oz Minerals booked another meet / beat, its 16th consecutive quarter of good numbers - the stock ended up +3.38% to $9.47 – we look at both stocks below.

On the economic front, more evidence that employment remains strong in Australia with the unemployment rate dropping to 5.0% versus 5.1% expected. The participation rate was a shade lower than expected which played into the better result, however importantly, we’re not seeing any meaningful deterioration in the labour market.

Data Today

Overall, the ASX 200 added +22points or +0.38% to 5865. Dow Futures are currently trading down -17pts or -0.07%

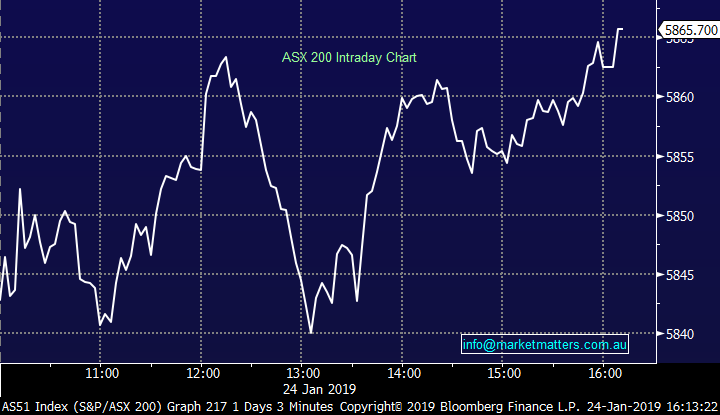

ASX 200 Chart- strong bounce from lunchtime low

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves; Feb earnings season is just around the corner and brokers are making some late calls ahead of the period. Today, broker downgrades focussed on Challenger Financial after yesterday’s downgrade while Regis Resources also copped it on the chin.

ELSEWHERE:

· Link Administration Resumed Outperform at Macquarie; PT A$8.90

· Challenger Downgraded to Neutral at Citi; PT A$8.40

· Challenger Cut to Neutral at Evans and Partners; PT A$8.98

· McMillan Shakespeare Upgraded to Buy at Citi; PT A$17.57

· Northern Star Downgraded to Neutral at UBS; Price Target A$9

· DuluxGroup Downgraded to Sell at Morningstar

· DuluxGroup Upgraded to Neutral at JPMorgan; PT A$6.80

· Adelaide Brighton Upgraded to Neutral at JPMorgan; PT A$4.50

· Regis Resources Downgraded to Underweight at JPMorgan; PT A$4.30

· Regis Resources Cut to Underperform at Credit Suisse; PT A$4.45

· Bingo Rated New Add at Morgans Financial; PT A$2.37

Oz Minerals (ASX:OZL) $9.47 / +3.38%; A nice set of production numbers from Oz Minerals (ASX:OZL) today, and one of the rare examples where we’ve seen costs trend lower through the period. Oz has now become well engrained as a company that meets / beats guidance estimates with the last 16 quarters of achieving guidance – a big turn-around from the Oz of old. That’s a consistent record that deserves credit and the market is starting to take note. Today they hit all production guidance metrics at the high end of the range. Costs are trending lower and were below the bottom end of the guided range due to a very low cost quarter at Prominent Hill. Oz is now at peak construction phase on the Carrapateena project, yet their balance sheet remains in great shape maintaining a cash balance around ~$500m while paying dividends. Operationally, this is a company performing very well and the balance sheet is in good shape, they just need some stronger commodity price tailwinds and the stock should start rocking & rolling. One clearly on our radar.

Oz Minerals (ASX:OZL) Chart

Evolution Mining (ASX:EVN) $3.71 / -4.13%; Outlined a soft operational quarter but on track for FY guidance. Dec quarter production numbers were softer than expected and softer than the prior quarter – which put some pressure on the stock today, however costs were in line with guidance / plan and will comfortably meet upper end of the range for the full year. These golds have had a cracking run and we’re starting to see anything that misses, or just meets get sold off. We like EVN into further weakness…

Evolution Mining (ASX:EVN) Chart

Santos (ASX: STO) $6.19 / +3.86%; The oil & gas name has rallied outperforming its peers following a meet / beat in the 4th quarter production numbers printed this morning. Production numbers were in line with the previous quarter as well as providing production guidance for 2019 which beat many analyst expectations. The December quarter did receive a small bump which supported production numbers, ensuring the figures do look better than expected. Santos completed the purchase of Quadrant Energy in late November, with many analysts not including the new asset in their figures at the time.

The market will now turn to the company’s full year result due out in late February which will provide a better read through of the Quadrant purchase, as well as cost and capex guidance for the year ahead. So far though, no surprises here which the market always takes a liking to. The company can only control so much however, with oil and gas prices fluctuating. With global growth fears looming, and a range of instability throughout the world, energy names aren’t yet attractive in our view.

Santos (ASX: STO) Chart

Vicinity Centres (ASX:VCX) $2.56 / -1.92%; The owner & manager of over 100 shopping centres across urban & regional areas in Australia published revaluations across their property portfolio noting a mixed bag in valuation changes resulting in a small fall in value since June of 2018. Interestingly, they noted a decent fall in neighbourhood & regional shopping centres offset by a 7.2% rise in value of the company’s outlet DFO branded centres. In total, the revaluations caused a 0.2% decline in the property portfolio, which leads to a small 1c fall in NTA down to $2.96 – still well above the current share price implying the market still thinks there is more pain to come. It’s hard to get excited about property in this environment…

Vicinity Centres (ASX:VCX) Chart

OUR CALLS

No trades today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/01/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.