Production Numbers pick up pace (OZL, S32, SRX)

WHAT MATTERED TODAY

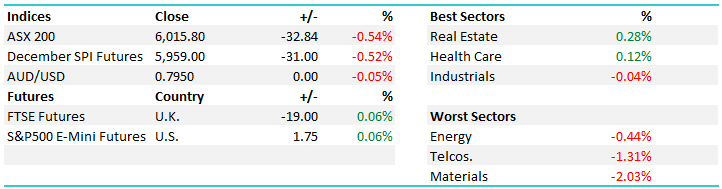

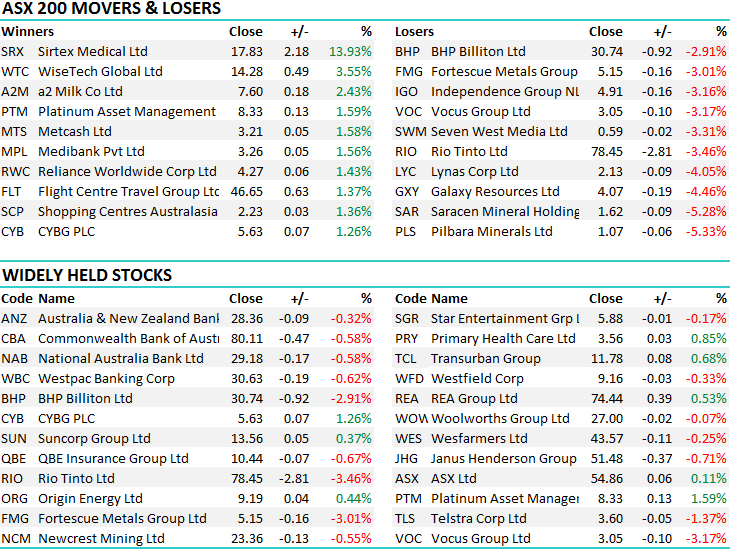

Commodities and banks both ended lower, resigning the market to a second consecutive fall. Selling was sustained throughout the day, mostly driven by overnight leads from the US, which reopened after a long weekend, and also soft commodity numbers in overseas trade. The big 4 all finished lower, while BHP & Rio fell 2.9% & 3.5% respectively. Sirtex upgraded guidance, helping healthcare end higher. Bellamy’s showed continued strength after upgrading numbers yesterday - this has also helped Chinese facing stocks in the past few days, such as A2M which also announced a greater push in to the US, finishing 2.4% higher. Suncorp managed to end better despite ASIC requesting the insurer refund customers $17mil for some dodgy car cover. All in all, a very similar day to yesterday when we wrote Really a day where the market collectively was soft yet a few stock specific stories helped to keep things interesting.

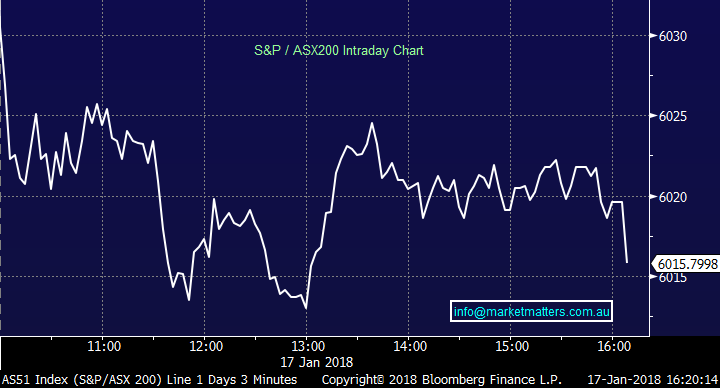

Real Estate topped the charts today, helped by shopping centre managers Scentre Group and Vicinity Centres finding some relief from 5 soft days. Materials were unsurprisingly the weakest, with their index falling over 2%. Overall, a range today of +/-24 points, a high of 6036, a low of 6012 and a close of 6015, down 32 pts or -0.54%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

CATCHING OUR EYE

1. Sirtex (SRX) $17.83 / +13.93%; the biotech & medical device company jumped today after a trading update that reported a material uplift in EBITDA, rising to $34Mil in the first half of the financial year, a 16% increase to the first half of FY17. Sirtex also provided full year guidance to $75-$85mil, up around 30% on the previous year, driven by increases to sales and productivity. The forecasts are particularly significant as SRX has missed the EBITDA guidance 3 of the last 5 reports, and today investors seemed to forgive and forget the recent troubles – along with plenty of shorts likely covering – sending SRX up ~20% in early trade before easing slightly. Sirtex will announce audited numbers on the 21st of February.

Sirtex (SRX) Daily Chart

2. South32 (S32) $3.92 / -1.51%; good production numbers released today, despite S32 closing softer. Manganese was the standout, with good numbers at a time where prices have been strong. Guidance for their South African manganese operation was also increased by 8% for the year, the highlight of the result. Demand for steel inputs remain high and S32 remain well positioned to benefit. South32 has advanced on the strongly from the rally in base metals and today’s weakness was likely a sign of investors using a strong result to lock in profits. We like S32, however wold be looking to enter at lower levels.

South32 (S32) Daily Chart

3. Oz Minerals (OZL) $9.17 / +0.99%; OZL also released their Q4 update, finishing the year with a wet sail to beat Gold expectations and meet copper guidance for the year while also increasing copper guidance for 2018 by ~10%. The increase in copper production will be to the detriment on their gold output, however the market brushed the shift, preferring to see OZL continue the move towards the red metal as has been occurring over the past few years. Other highlights was the lift in free cash flow, adding $90mil to the OZL accounts in the quarter and the continued decline in production costs/lb. We like OZL, however we are looking to enter around $8.

Oz Minerals (OZL) Daily Chart

OUR CALLS

We allocated 3% of the Growth Portfolio to BHP today. Our other order for 3% into Zip Money was not filled, with the limit remaining at $0.84 – only a small number of shares were traded there after the alert was released.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/01/2018. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here