Our current view on the bank trade

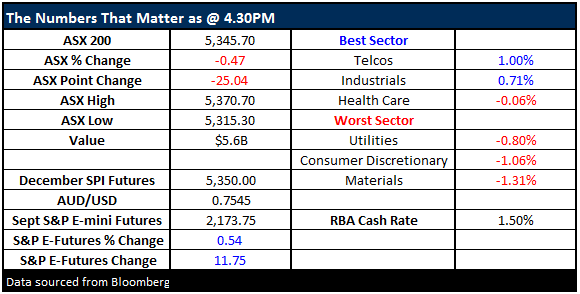

What Mattered Today

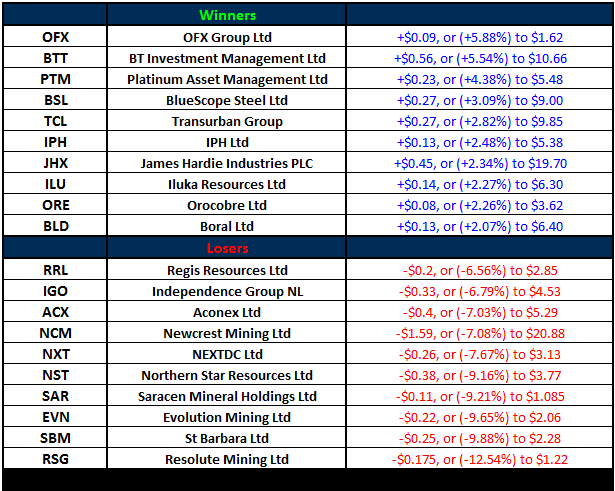

The market pulled back today after a fairly hectic past week – global fund managers saw most buying with the likes BT (BTT) +5.54% and Platinum (PTM) +4.38% rallying strongly while we saw Macquarie (MQG) & QBE (QBE) closed mixed - but a reasonable way up from the intra-session lows. A tale of two halves in the banks with ANZ & WBC trading ex-dividend and taking around 15 points off the index. WBC went ex for 94cps fully franked ($1.34 grossed) and closed down $1.01 while ANZ fell just 41cps after going ex for 80cps fully franked ($1.14 grossed).

Westpac (WBC) Daily Chart

ANZ (ANZ) Daily Chart

We had more positive news for the banks with APRA coming out to say that…Basel IV will require no significant lift in the overall capital - APRA will consult with the industry until at least this time next year - any new standards will not take effect until at least a year after that. So any new requirements will impact 2018/19 ratios at the earliest and there is unlikely to be a more life in capital requirements. APRAsaying any changes will be able to be managed in an orderly fashion.

So, if we think about Banks, the main headwinds have been;

Capital – increasing capital requirement has seen the market think that banks are cum-raise – that they’ll issue shares to beef up tier 1 capital in the post-Basel IV world – That’s now unlikely as confirmed by APRA.

Margins – low-interest rates have put big pressure on margins – a steepening yield curve, as we wrote about in the Weekend Report helps to relieve margin pressure – margins improve and so too do earnings – Rising rates help banks if they don’t put too much pressure on asset prices which we think is unlikely

Dividends – Payout ratios are high but the banks will probably muddle through and grow into their dividends. They’ve become safer, holding more capital, but will be lower growth. Most think NAB will cut their divi next year, we reckon they’ll hold it.

Bad debts – The bounce in resources has helped the outlook for bad debts + if we don’t see a housing mkt crash – which seems unlikely (but it always does on the way up) then bad debts should be OK – really depends on interest rates which we think go higher, but not materially so

All this boils down into the realisation that the tough operating conditions seen by the banks over the past few years, conditions that saw CBA trade from $95 to $70 are starting to turn…It’s an example of the sort of investments we need to be focussing on.

To that end, we bought two stocks – both stocks that are reasonably cheap and the conditions that have worked against them in recent times are starting to turn in their favour. We allocated 4% in each and will average in if they pullback further.

Elsewhere, the GOLD stocks continued to cop it on the chin with the top 5 losers all from that sector. We think the $US goes higher from here to a potential major top in the next few weeks. A higher $US makes gold unappealing for now….

Resources more broadly have run too hot – and the same force with the $US rising should cap them at some point soon. Clearly, the likes of RIO & FMG have run very hard and now the most talk is very positive around the resource stocks – higher Iron Ore price means these guys are due to an upgrade BUT the mkt has it already well and truly factored in it would seem…We are contemplating a couple of names into weakness Remember, things can change pretty quickly in resource land and the fact that now it’s a very much talked about trade should make you wary – as we are.

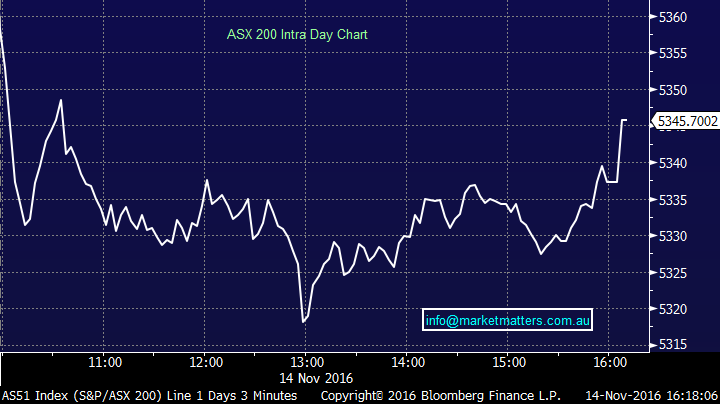

On the market today, we had a range of +/- 44 points, a high of 5359, a low of 5315 and a close of 5345, off -25pts or -0.47%.

ASX 200 Intra-Day Chart

ASX 200 daily chart

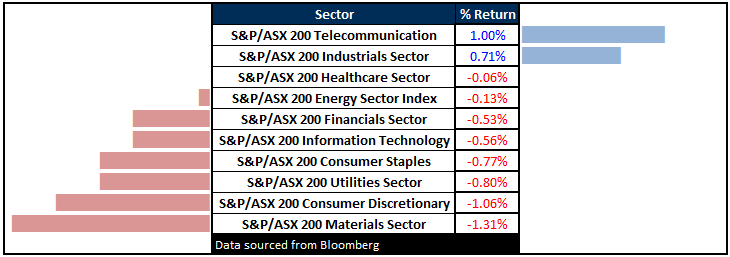

Sectors; Telstra (TLS) bounced today which got the telco sector up for the session, however, it is coming off a low base. The stock had a low of $4.70 on Friday which was our initial downside target. We now think $4.50 is a more realistic price point near term given the move away from the yield trade, and the likely hood that it will be pushed too far on the downside, just as it was pushed too hard on the upside.

ASX 200 Movers – Some buying in Transurban (TCL) today…Pretty aggressive selling of the GOLDS

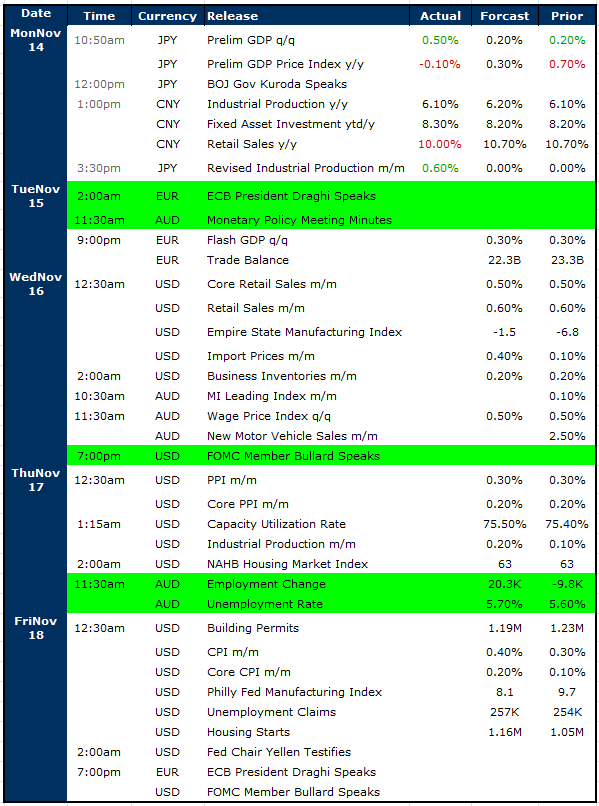

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

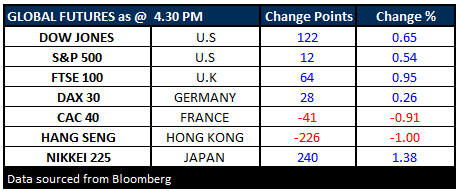

FUTURES in the States up again….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/11/2016. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here