The property platform similar to REA Group (REA) is doing exceptionally well in a difficult US housing market, Q3 results showed overnight, sending the stock up 25%.

- Total revenue of $US581 million was up +17% for the year, ~5% ahead of consensus.

- This was largely driven by residential revenue of $US405 million, which increased +12% and was 6% ahead of expectations.

- However, other components from rentals revenue (+24% YoY) and mortgages (+63% YoY) contributed nicely and show that the platform as a whole is working particularly well.

- This underpinned a 19% increase in earnings (Ebitda) to $US127 million, 17% ahead of consensus, highlighting the operating leverage in these platform businesses.

The key message overnight was that ZG is performing well, even against a challenging housing backdrop. When the backdrop improves, ZG will be in a great position to take advantage of it. They enjoyed an average monthly unique visitor of 233 million to their site, with increased traffic converting well—i.e., the flywheel is working.

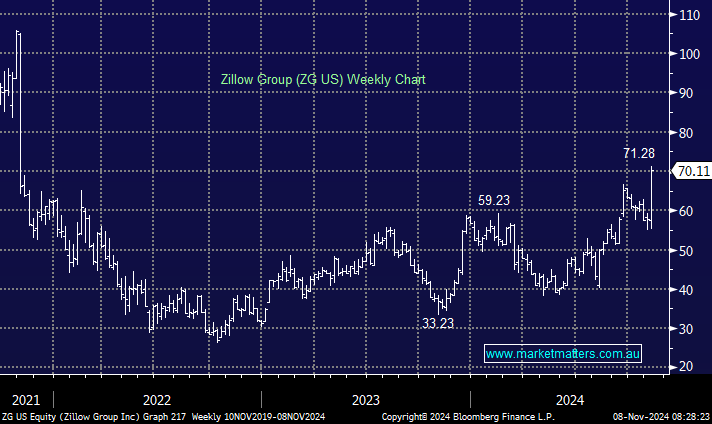

Guidance for Q4 was solid, and inline to a slight beat to expectations, and after a challenging few years, ZG is back on track. While the stock has now more than doubled from its lows, it’s still yards below its all-time highs above $US200.

- We bought ZG 5 months ago in the International Equities Portfolio, and while we’re now up over 50%, we believe there is more upside in this real-estate platform.