The US based outdoor brand that makes coolers or esky’s as we call them, along with a bunch of other great products was up as much as 20% early on overnight before closing 12.78% higher following a strong beat on quarterly earnings, driven by the trio of stronger sales, better gross margin and lower expenses. They saw very good growth in their international business that made up 19% of sales, the highest proportion ever, while they talked to lower input costs and ongoing progress in product innovation.

They upgraded FY24 guidance and now expect adjusted EPS of $2.49 to $2.62, up from $2.45 to $2.50, which implies that YETI will grow earnings at 16% this year – a good clip.

From experience, these are simply great products that are finally gaining traction outside the US market.

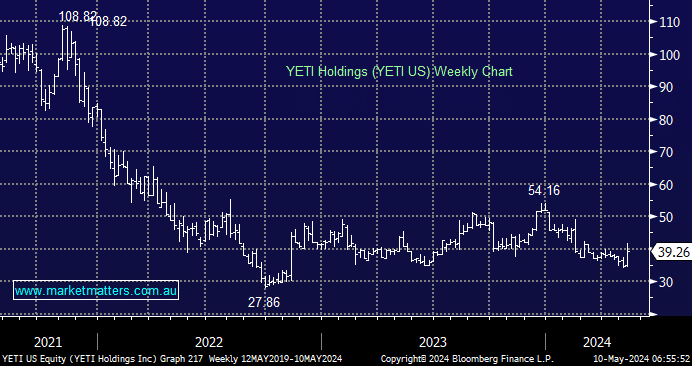

We’ve had to be patient with our position in YETI, buying it in February 2023 around current prices, however we think the tide is turning and we expect more upside from here – MM is long YETI Holdings in our International Companies Portfolio.