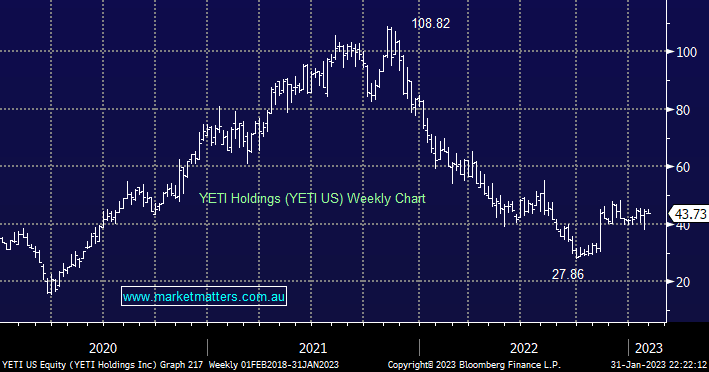

I was in the market for a new esky last year and considered Yeti, a higher-end US brand that makes top-quality coolers. I have a few of their other products and they are simply sensational, albeit with a high price tag. Steve Johnson from Forager Funds recently wrote about buying the stock for their international fund while analysts generally like it, with 10 buys, 5 holds and no sells, and a consensus price target 21% above its current share price. The business started in 2006 but was only listed in 2018. Since listing it’s had impressive growth, and if history is a guide, should increase revenue by more than 10% YoY with earnings set to increase by ~15% or more. But, 2022 bucked this trend with a dip in earnings and a big re-rate lower in the multiple the market was prepared to pay for this outdoor brand, and the stock fell ~70% from its all-time high around $US107 down to a ~$US30. We ask ourselves, is this now a ‘buy’?

They report earnings in early February that will likely show a dip in profits, the first time in over a decade, but the share price decline has already pre-empted this. Trading on an Est PE of 18x while growing earnings at ~15% or more looks interesting, but the more important aspect here is their overseas growth opportunity. 90% of their earnings are in the US, with Canada and Australia now two other growing markets, however, with such a strong brand, a great set of products, and some very interesting partnerships (with boat companies like Seafox), we are positive on Yeti’s prospects, and are adding it to our hitlist. Our only two reservations, for now, are their upcoming earnings report & our existing exposure in retail for this portfolio.