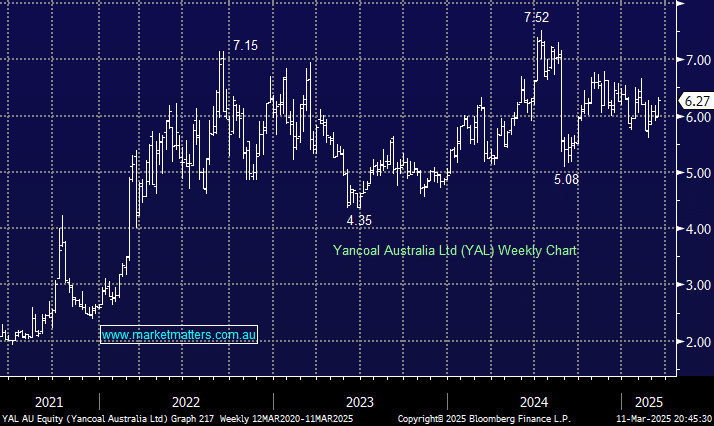

A strong historical dividend and a lack of mainstream broker coverage are perhaps the two main reasons we consistently get a high volume of questions/queries on Yancoal (YAL). It has traditionally been our least preferred coal company, given its ~75% owned by two Chinese entities, and we think that has an impact on the company’s decisions at the board level. However, like all commodity companies, the direction of the underlying commodity price will have the most significant bearing on the share price over time.

Commodity prices follow the balance between supply and demand. If supply outstrips demand, prices fall. When demand outstrips supply, prices rise. To that end, we think early signs are emerging that both Thermal and Metallurgical Coal prices are bottoming, after a very tough run, while the medium-term drivers of coal prices remain solid, in our view.

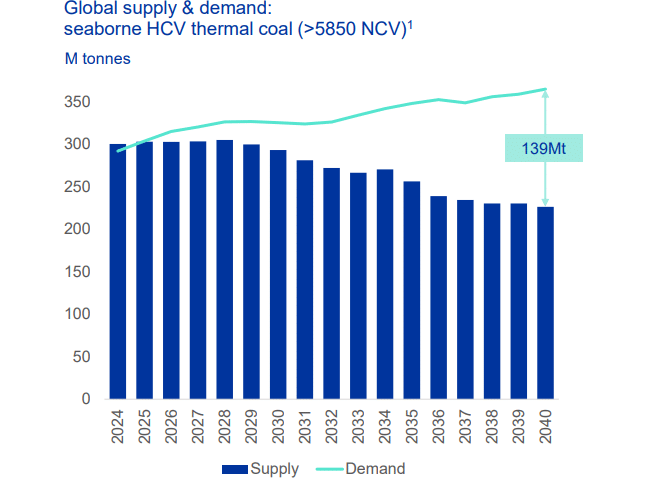

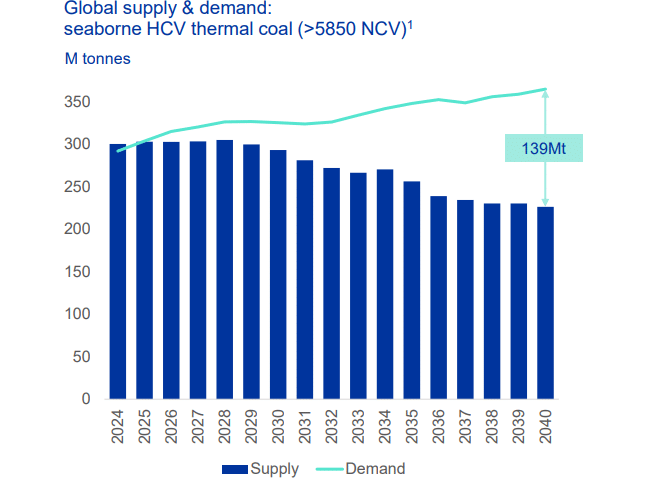

The below graphic is borrowed from Whitehaven’s recent results pack and uses third-party industry data to chart the difference between forecast supply and demand for Thermal Coal out to 2040. Thermal coal makes up 70-80% of YAL’s earnings.

The graphic shows supply currently outstripping demand in 2024. However, the market will become more balanced in 2025, and from 2026 onwards, demand will start to outstrip supply. This is a positive dynamic for prices, earnings, and, therefore, dividends. YAL recently declared a $0.52 per share dividend, fully franked (trading ex-dividend tomorrow), which puts it on a yield for the half of 8.3% (11.8% incl. franking), which is clearly attractive.

We have written about the risks around the dividend before, most notably in August 2024, when despite reporting a half-year profit of $420 million and maintaining a cash balance of $1.55 billion with no debt, they announced no interim dividend so they could accumulate funds for potential acquisitions, notably targeting Anglo American’s Queensland metallurgical coal assets. This move clearly shows their desire to prioritise strategic acquisitions, which may influence future dividend decisions. However, for now, the dividend coming up tomorrow is being paid, while the outlook is starting to improve for the sector more broadly.

- We hold New Hope Corp (NHC) in the Income Portfolio and Whitehaven Coal (WHC) in the Growth Portfolio; however, Yancoal (YAL) is an option in the space for a higher dividend yield, though we think it presents a higher level of corporate governance risk.

We ultimately see solid risk/reward in buying the stock today for tomorrow’s dividend and holding it for 45 days to accrue the franking credits.