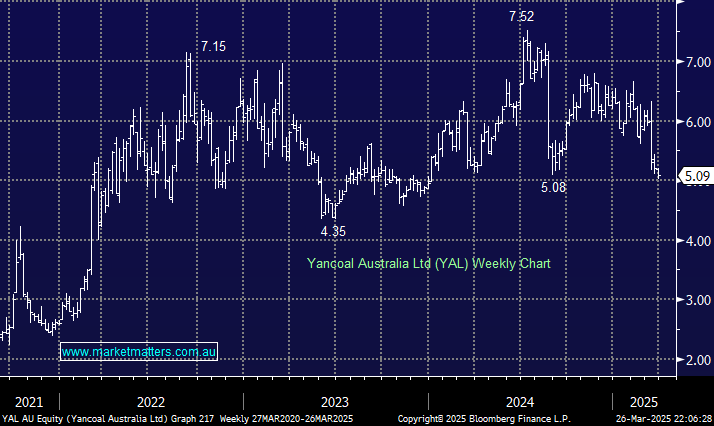

YAL has always been a complex coal and dividend play due to its ~75% ownership by two Chinese entities, which may influence their decision-making processes. It’s a stock which has garnered significant interest from MM members over the years due to its colossal dividend, which is forecast to be ~16% over the coming 12 months. But, in August last year, the risks came home for this “yield play” when, despite reporting a half-year profit of $420 million and maintaining a cash balance of $1.55 billion with no debt, they announced no interim dividend so they could accumulate funds for potential acquisitions – a massive pivot for the company which saw the stock crash ~30% as investors holding YAL for income ran for the exits.

However, in February 2025, Yancoal ‘s board declared a final dividend of 52c (fully franked) for the 2024 financial year, amounting to a total distribution of $687 million. This feels like an excellent yield play, until one day. The risk/reward looks good at ~$5, but we wouldn’t be surprised to see a dip towards $4.50 for a couple of reasons:

- Coal prices continue to struggle, weighing on related ASX stocks, such as YAL.

- As coal assets become available, YAL will again be running their ruler across the numbers, putting dividends in jeopardy.

This is not an income play for the faint-hearted conservative investor, as we saw last year, the dividend could vanish overnight.

- We believe $6.7bn YAL is solid value, considering its cash level and lack of debt, but sentiment is not great towards coal and they’ve demonstrated a desire to buy stuff, at the expense of the dividend.