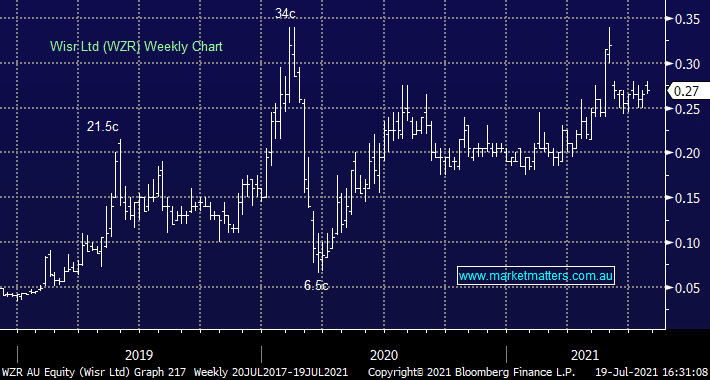

WZR +1.89%: an impressive quarterly from the personal lending business Wisr. Their 4th quarter loan originations came in at $123m which is almost triple that of the 4th quarter FY20, and 27% more than the 3rd quarter this year. Wisr continues to prove it can grow its loan book substantially without reducing credit standards, maintaining a low bad debt charge and high credit score average across the book. It’s cashed up following a bigger than expected equity raise which has put some pressure on the share price in recent months, but ultimately it’s proving to be a solid operation in the space.

scroll

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Close

Close

MM remains bullish & long WZR

Add To Hit List

Related Q&A

WZR

Switching from Wisr to Liberty?

What’s up with Wisr (WZR)?

Australian Strategic Materials & Wisr- MM’s take

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

chart

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.