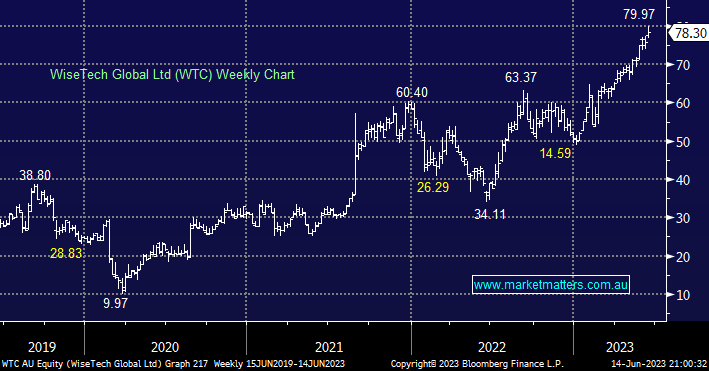

WTC has soared well over +50% through 2023 posting fresh all-time highs earlier this week, this cloud-based logistics software solutions business announced revenue growth of 35% to $378.2mn in February and as has been the trend this year it’s gotten stronger & stronger. Our main concern has been whether the company’s performance can be sustained as it needs to justify its lofty valuation but in hindsight, we have been too conservative. In line with our revised bullish outlook for tech over the medium term, we will consider WTC into its next 10% pullback of which 2 or 3 are common for the stock on an almost annual basis.

- WTC has been a great performer in 2023 and we continue to like the stock into a decent pullback towards $70.