- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The ASX finished modestly higher as a rare day of strength for the IT stocks and continued support for the gold miners offset broader caution across banks and consumer shares. While the headlines have cooled through the week, geopolitical tension and rake hike expectations continue to reinforce nervous sentiment, as the market positions for what will likely be a volatile reporting season ahead – both here and in the US.

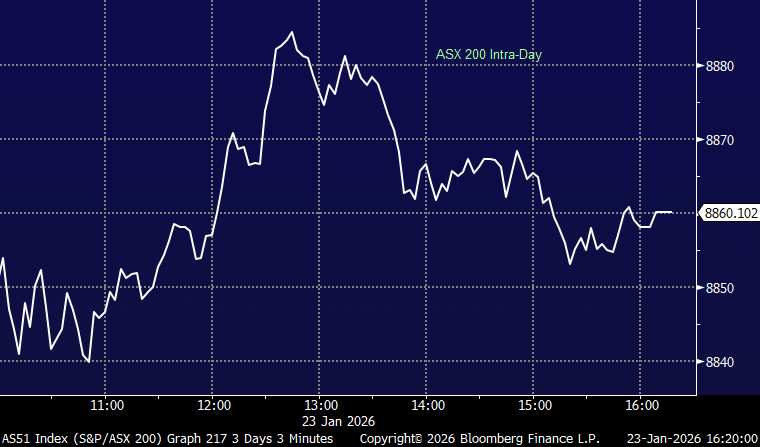

- The ASX200 added+11pts/+0.13% to close at 8860.

- IT (+3.83%), Materials (+1.44%) and Communications (+0.26%) led the line.

- Staples (-1.11%), Consumer Discretionary (-0.72%) and Financials (-0.5%) the weakest links.

- For the week, the ASX 200 fell 0.5% overall with Real Estate the weakest link on rate hike expectations which Financials were also on the soft side.

- The AUD hit a 16-month high today at US68.50c – looks enroute to 70c.

- Life360 (360) +27.37% surged after upgrading full-year guidance and reporting near-record monthly active users, leading the technology sector higher.

- NextDC (NXT) +2.7% rose on continued optimism around data-centre demand tied to AI and cloud investment.

- Xero (XRO) +3.54% advanced as the tech sector finally found some love after relentless selling in recent times.

- Northern Star (NST) +5.4%, Newmont (NEM) +3.8% and Evolution Mining (EVN) +5.3% led the gold miners, which rallied in line with the surge in bullion.

- Domino’s Pizza Enterprises (DMP) +0.91% traded firmer but became the most shorted stock on the ASX, reflecting ongoing skepticism around valuation and earnings recovery.

- Guzman y Gomez (GYG) +3.8% gained after announcing a multi-year exclusive delivery partnership with Uber Eats in Australia.

- Capstone Copper (CSC) −3.36% fell after union strikes caused disruptions at its Mantoverde mine in Chile, temporarily halting sulphide production.

- Gold was up ~$20/oz, trading at US$4957/oz around our close Iron ore was higher, trading $US104.55/mt

- Asian markets were higher, with China up +0.4%, Hong Kong up +0.4% and Japan +0.1%.

- US futures are trading up +0.20%.