- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

Weakness crept back into the market today as more traders got back behind their desks post Christmas break, with volumes increasing across the board. After a flat start to trade, US Futures came under pressure as Trump threatened 10% tariffs on several European countries from February, rising to 25% in June, unless the European Union agrees to negotiations linked to the “purchase of Greenland”.

8 of 11 sectors traded low, with safe havens such as Gold & Utilities the place to be while the broader resource sector was well supported on solid Chinese growth data.

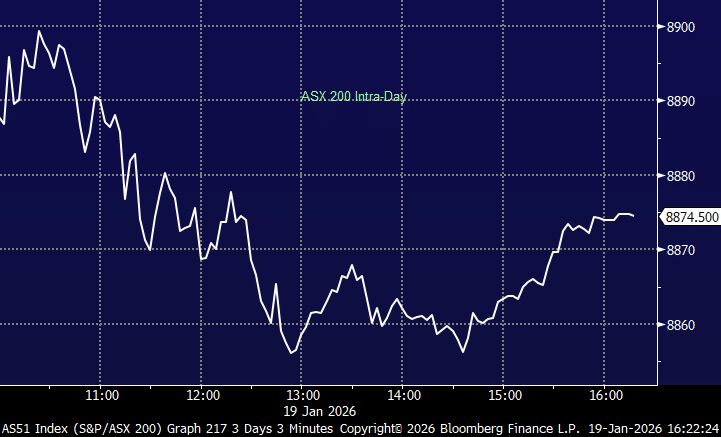

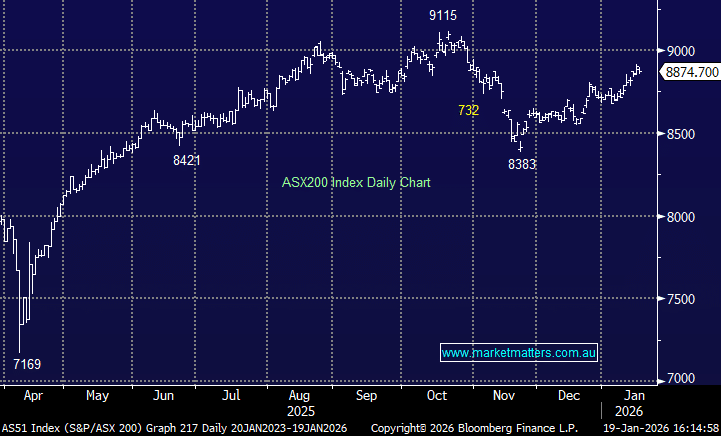

- The ASX200 fell-29pts/-0.33% to close at 8874.

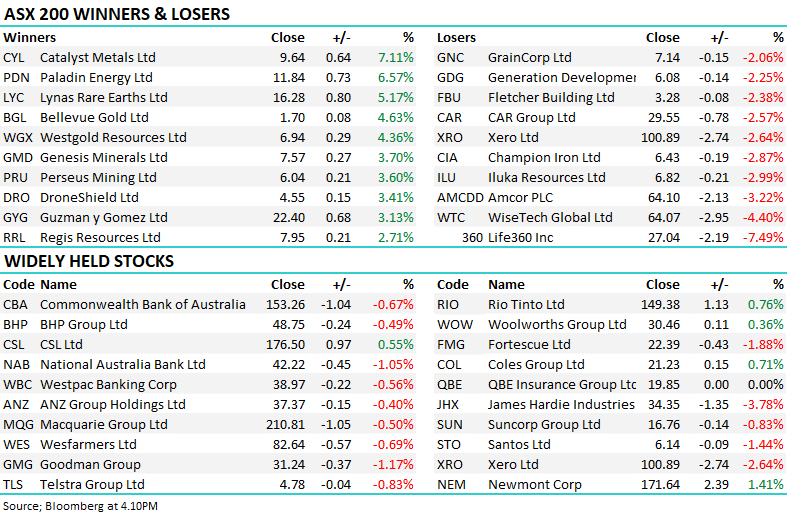

- Utilities (+0.99%), Materials (+0.42%) and Energy (+0.20%) the three sectors that finished higher.

- IT (-2.49%), Communications (-1.11%) and Consumer Discretionary (-0.76%) the weakest links.

- China reported GDP growth of 5% in 2025, meeting the government’s target, though growth slowed to 4.5% in the December quarter, highlighting ongoing weakness in domestic demand despite strong exports.

- Gold stocks continued to surge with geopolitical rumblings growing louder by the day – Northern Star Resources (NST) +3.2%, Perseus Mining (PRU) +3.6% and Bellevue Gold (BGL) +4.6%.

- Catalyst Metals (CYL) +7.1% reported a new high-grade gold discovery at their Cinnamon project in the Plutonic gold belt in Western Australia.

- High-multiple stocks were hit with WiseTech Global (WTC) -4.4% and Life360 (360) -7.5% extending recent heavy selling.

- NextDC (NXT) +1.2% bucked the tech-selloff trend as its M4 Melbourne data centre development application was approved

- The Big Four were modestly lower but still enough to weigh on the index ANZ -0.4%, Commonwealth Bank (CBA) -0.7%, Westpac (WBC) -0.6% with NAB –1% falling the most.

- City Chic Collective (CCX) +3.6% rose after reporting first-half revenue of $69.2m, down 0.5% YoY, with ANZ growth offset by a 31.4% slump in Americas sales as inventory purchases were cut amid tariff uncertainty

- NRW Holdings (NWH) -2.7% was lower despite its Golding Contractors subsidiary securing a $750m, 5.5-year mining services contract at Queensland’s Stanwell Meandu Mine

- Syrah Resources (SYR) was flat after the graphite miner secured an extension to March 16 to remedy an alleged breach of its Tesla offtake agreement.

- PolyNovo (PNV) -0.4% after reporting a 26% jump in unaudited first-half sales to $68.2m

- Treasury Wine Estates (TWE) +0.7% after European billionaire Olivier Goudet lifted his stake to 6.13%.

- Gold rallied $US75/oz during our time zone today, trading at US$4671/oz – which equates to just shy of $A7000/oz – phenomenal!

- Iron ore was mildly higher trading $US111.55/mt

- Asian markets were mixed, with China up +0.4%, Hong Kong off –0.8% and Japan down -1%

- US futures fell ~1% during our time zone today.