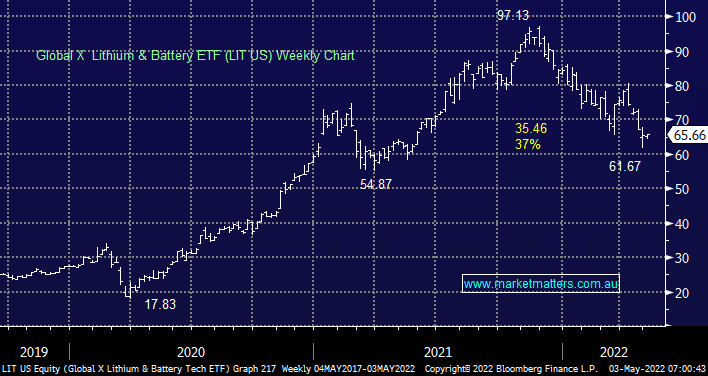

Socially responsible ESG investing has seen a huge inflow of funds over recent years with 2021 arguably the year that really catapulted the trend into the limelight, ESG funds now account for around 10% of worldwide assets although it now it looks like things got ahead of themselves with the Global X Lithium & Battery ETF (LIT US) already correcting 37% from its November high. Like many “hot” trends in stocks things can get ahead of themselves even if the theme has foundation and we believe this has been the case with the ESG sector i.e. EV’s are here to stay but a companies valuation should still be determined by simple traditional methods such as earnings now, and in the future. A good example of the level of speculation in 2021 was the broking platform Robinhood which benefitted from the huge volumes of new traders entering the market. Revenue has since dropped over 70% since those heady levels of 2021 with the stock down a similar amount.

- E stands for environmental impacts that a company has on the planet e.g. carbon footprint and recycling practices.

- S stands for social covering issues around employees, customers and the community.

- G stands for governance and covers areas such as leadership and business ethics.

Just as stocks with fossil fuel exposure have been rerated on the downside from a P/E perspective so have ESG names on the upside as investors want to feel good about their investment process, but it hasn’t necessarily led to good returns over the last few months because stocks can rally even with a lower P/E e.g. so far in 2022 Whitehaven Coal (WHC) is +86% while lithium miner Pilbara Minerals (PLS) is down 17%. At MM we’ve largely been on the correct side of this skew as we’ve avoided the overcrowded ESG space in preference of cheap fossil fuel names however like all elastic band things can only stretch so far.