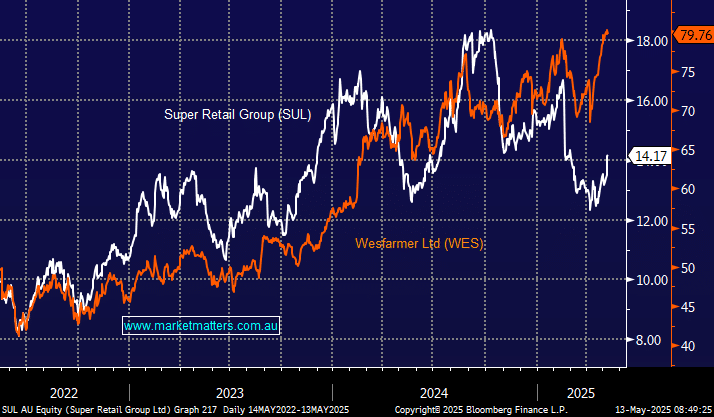

WES has advanced over 11% in 2025, but it looks and feels tired around $80 as it starts to lose its safety attraction. More importantly, it’s stretched from a valuation perspective, which is not new for WES given its quality and diverse mix of earnings, however, they are a demonstrated beneficiary of fear, and as fear eases, they will likely underperform.

We prefer Super Retail Group (SUL) in the consumer discretionary space; it’s down over 6% year-to-date, not overly expensive and yields around 5.6%. Plus, SUL delivered a market-friendly trading update this month, albeit into fairly low expectations.

- We like WES as a business, but it looks fully valued at around $80.

- We hold SUL in our Active Growth and Active Income Portfolios.