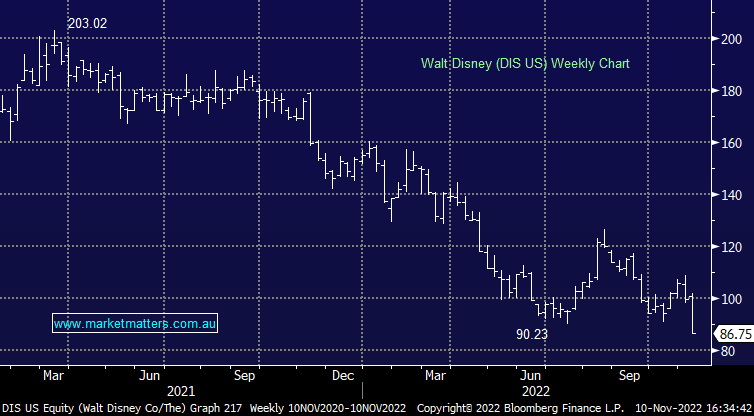

DIS -13.16% Q4 results out after market on Wednesday with the negative reaction overnight warranted. The only positive was subscriber growth in their streaming business ~30% above consensus which implies their target for achieving streaming profitability in fiscal 2024 should become reality. Still, the rest of the result was weaker than hoped with theme park margins softer and their broader direct to consumer (DTC) business which includes global advertising sales, overseas media assets, streaming and syndicated TV missing earnings expectations. Clearly this is a big company that is being impacted by the broader macro environment leading to a ~5% revenue miss and more at the earnings line, however we continue to believe that Disney is best positioned to win in streaming supported by the best depth of content.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM will continue to hold DIS US

Add To Hit List

Related Q&A

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.