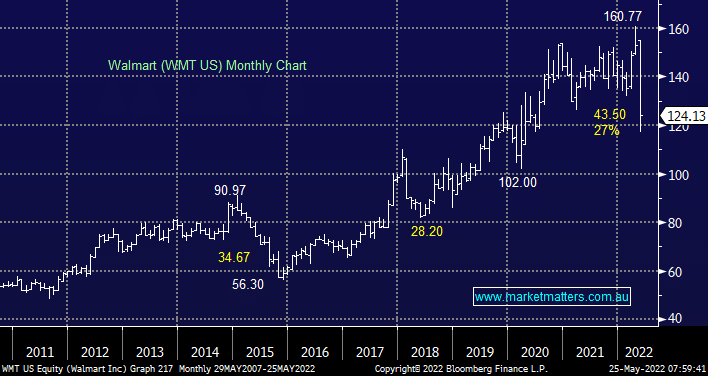

Last week we saw US retailer Target (TGT US) plunge 25% on inflation fears leading to its first-quarter profit halving as the company warned of a larger margin hit due to rising fuel and freight costs – the stock fell the most since the “Black Monday” crash of 1987. Similarly Walmart (WMT US) posted its worst day in 35-years after posting a disappointing earnings report primarily being pressured by rising cost of labour and shipping.

However while these are very real issues history tells us they will ultimately be passed onto the consumer i.e. you and I. At this stage we aren’t considering fighting the wave of negativity towards these names but if we see a few months of “risk on” sentiment help tech names recover some of their painful losses over the last 6-months the elastic band is likely to become very stretched and MM will be considering a switch from one of our tech holdings in WMT, or sector peer depending on valuations at the time.