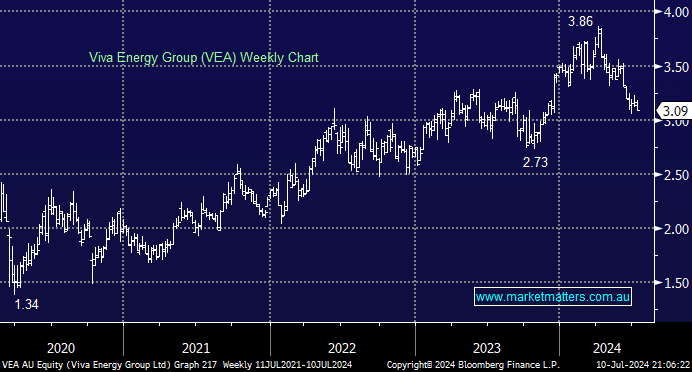

VEA is one of Australia’s leading integrated downstream petroleum companies, having the sole right to use the Shell brand to sell petroleum products in Australia. Its stock fell 2.8% on Wednesday, taking its decline from early April highs to over 20%. Declining tobacco sales and cost of living pressures continue to weigh on their convenience business even as margins improve. The stock’s P/E is now over 30% below its average of the last five years, but it’s still not tempting us due to evolving macro factors.

- We are concerned about the long-term outlook for VEA as people continue to convert to EVs.