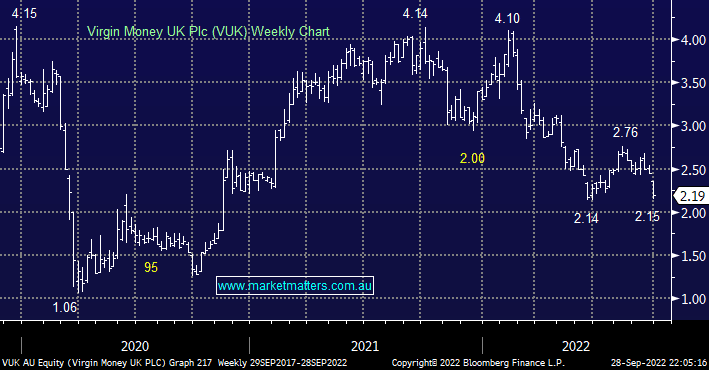

VUK has now fallen -48% from its 2021 highs and while it scans extremely cheap compared to its peers it is based in the UK which is likely to see ongoing volatility across its related financial markets as the government cuts taxes while at the same time the BOE hikes rates and now buys bonds = an unfathomable arm wrestle which we feel is best avoided.

- We remain unlikely to buy VUK into the current weakness but the stock does feel good value under $2.20.