VNT is a $4.4bn infrastructure services provider, operating in Australia and New Zealand. It manages, operates and maintains critical public and private assets, including telecommunications, defence bases, energy networks, water systems, and road & rail infrastructure. Before listing in late 2021, it was jointly owned by CIMIC Group (formerly Leighton Holdings) and private equity firm Apollo Global Management and operated under the “Leighton Services” brand. So far, the stock has rewarded investors in 2025, advancing close to 50% tracking revenue, which has risen steadily from $4.6bn in 2021 to an Est. $6.2bn in 2025.

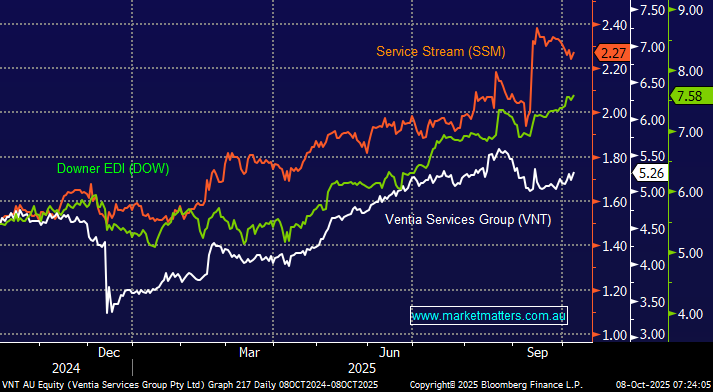

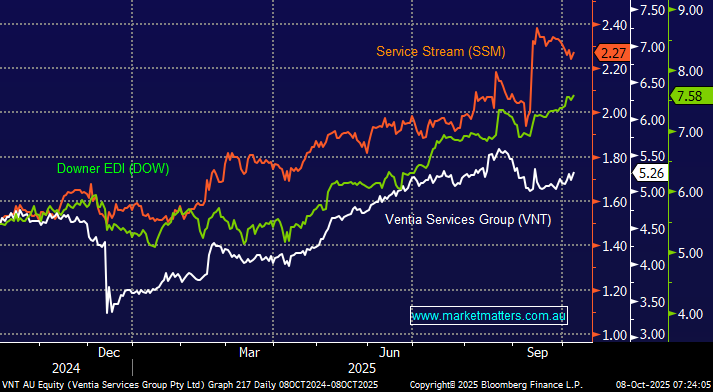

Last month saw VNT win two base services transformation contracts from the Australian Defence Dept. valued at $2.7bn over an initial 6-year term with two extension options to a maximum of 10-years. Ventia’s main competitors are the large infrastructure and facilities services providers, such as Downer (DOW) and Service Stream (SSM), who have both performed strongly year-to-date. Interestingly, DOW and VNT have recently been successful in winning government defence contracts worth a combined $5.75 billion despite battling a lawsuit brought by the competition watchdog, which alleges they engaged in price-fixing. Defence and social infrastructure contribute a bigger proportion of earnings than any other sector for Ventia, outstripping telecommunications, infrastructure services and transport.

- The ACCC filed documents in the Federal Court supporting its allegations in early September, with DOW and VNT, which are defending the claims, due to file evidence by early December.

VNT are clearly fishing in the right pond with global defence spending surging almost as fast as AI and gold! In FY24, VNT recorded over 40% of its revenue from defence, with that number set to increase in the years ahead. The stock surged to fresh highs in August after delivering strong 1H earnings with NPAT of ~$119.4 million, coming in up +11.9% YoY and increasing its buyback to $150mn:

- VNT is forecast to yield just over 4%, mostly franked, over the coming 12-months.

We like VNT for exposure to increased defence spending; it’s already a sound business, paying a solid dividend and executing buybacks. Hence, when the “Hot” defence sector cools, the damage to the likes of VNT is likely to be relatively muted.

Having established we like VNT, the next obvious question is why not buy the slightly larger DOW, with both stocks up between 44 and 46% in 2025. They are both trading on a very similar valuation, with DOW also executing a buyback, although VNT does yield slightly higher. We prefer VNT due to their primary revenue mix of defence, utilities and telco as opposed to DOW’s current transport bias. We also think DOW has already “squeezed the orange” in terms of cost savings and divestments.

- We are targeting fresh highs for VNT into Christmas, but are conscious of the Fed Court ruling moving forward.