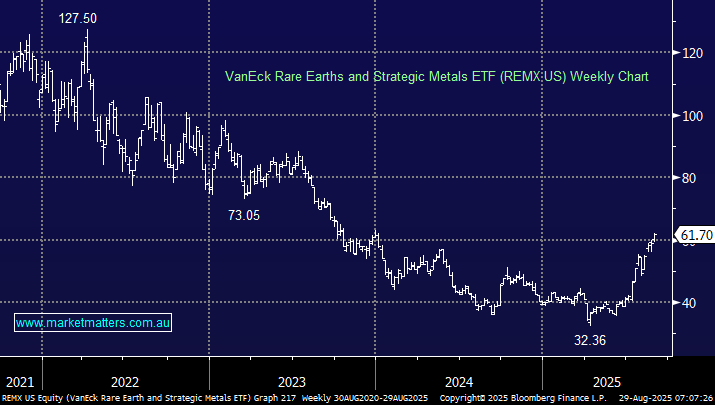

The VanEck REMX ETF is our preferred rare earths ETF, unfortunately it’s not traded on the ASX but it’s a far purer play than the XMET ETF which is more energy transition focused. This large US ETF has a market cap of over $1bn as its aims to track the MVIS Rare Earth/Strategic Metals Index, which it does well: over the last 5-years, the index has returned 10.5% and the ETF 10.8%. The ETF costs 0.58% pa, but it provides access to a global group of 23 (currently) rare earth and strategic metals companies from China to the US and Chile.

- From a regional perspective the ETFs main exposures are 32% in China, 30% Australia, 19% the US and then 6% Chile.

- The ETF’s five holdings are China Northern Rare Earths 10.9%, MP Materials (MP US) 10.9%, Lynas (LYC) 7.8%, Albermarle (ALB US) 7%, and Pilbara (PLS) 6%.

In terms of a one-trade, global exposure, REMX the most relevant play granting exposure to not only the current supply-demand shock but more broadly rare earths’ growing utility in advanced technologies and defense in the future.

- We like the risk/reward towards the XMET ETF below $US55 although this may be too optimistic.