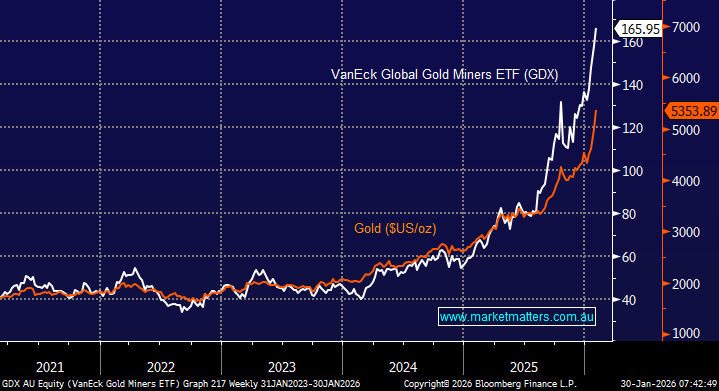

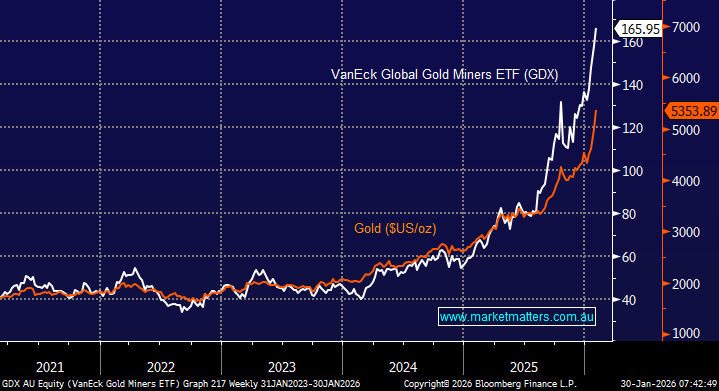

Unlike copper stocks, gold names haven’t run ahead of the underlying precious metal. In 2026, the GFDX ETF has advanced +28%, dancing almost in sync with the precious metal. The parabolic advance by precious metals feels dangerous, and at MM, we take one important read-through from the current price action in the metal sector.

- When gold does take a rest, or pullback, there will be strong valuation support for gold stocks into dips.

Gold stocks are set to be cash cows in the coming years, assuming the precious metals can hold the majority of recent gains, reminding us of the coal stocks back in 2022 – dividends and capital initiatives are likely to come to the fore. Last October, the precious metals market underwent a major shakeout, clearing out many weak longs and speculative positions as the “crowded trade” unwound in a classic panic with everyone heading for the exit at the same time – in a single session, spot gold plunged as much as 6.3%, its sharpest one-day fall in over a decade, while spot silver tumbled 8.7%, despite no specific catalyst – last night eclipsed that volatility! It sounds like the famous 70’s Jaws movies = “Is it safe to go back in water?” Not yet, in our opinion.

- We are looking for the GDX ETF to rotate between $140 and $170 over the coming weeks/months – no hurry to buy yet.