Brazilian mining giant Vale (VALE US) is the largest Iron Ore miner in the world, producing 328 million tonnes in 2024, just topping Rio Tinto’s 323Mt haul, while BHP (256Mt) and Fortescue (193Mt) round out the top 4. Importantly, Vale is the most significant producer of premium-grade output, and among the world’s lowest cost producers, with a C1 cash cost in 1Q25 of $US21.00/Mt. Volumes drive down unit costs, and as they continue to push higher tonnes through their operations, we’re likely to see ongoing cost benefits, with C1 tracking towards $US18.00/Mt in the next 5 years as they move towards an annual run rate of 360/Mt. These cost efficiencies provide a strong buffer against volatility in iron ore prices and should underpin sustainable profitability.

- For context, Vale is tipped to make ~$US7.7bn in FY25 (December year-end) and it trades on just 3.8x EV/EBITDA or from a PE perspective, 6x FY25 consensus earnings.

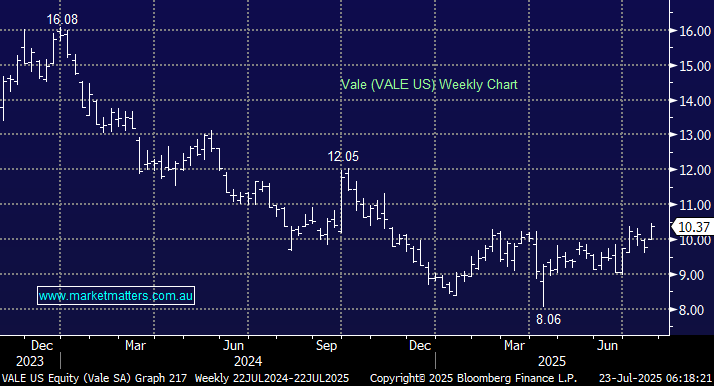

This is very low from a historical sense, though there are reasons for it. Firstly, they operate in Brazil, which has a higher level of risk than Australian-based producers. Political instability and regulatory uncertainty are more prominent, and they’ve also been responsible for two major tailing dam disasters: Samarco in 2015 of which BHP was involved, which was an environmental disaster, and another in 2019, called Brumadinho, which killed ~270 people. In a world where ESG has become an influential screening mechanism for global investors, the disasters ruined Vale’s global reputation, cost them billions in liabilities, and ultimately pushed their share price down to a deep discount relative to Australian peers. While not our base case, if Vale were to re-rate towards a similar multiple to Australian peers, and assuming stable earnings, the share price would have at least 50% upside from current levels.

Important to note, while Iron Ore is not our highest conviction commodity call, we do think the market has become overly bearish on a very important ingredient required to fuel the global energy transition. The term ‘Future Facing Commodity’ generally refers to minerals like copper, rare earths & lithium, but we’d argue that Iron Ore is being unfairly left out of the discussion. It’s difficult to make wind turbines, solar farms, hydro capacity and EV’s without Steel, and while recycling of scrap is of growing importance, it will not displace iron ore-based production for decades. Additionally, Green Steel will become an important concept in the future, and without going into too much detail, it requires a higher grade (usually pellets) to feed into a Direct Reduction (DR) plant that uses green hydrogen and other renewable energy to make near zero net emission Steel.

- This is a higher risk investment relative to the Australian miners, and subscribers may ask why we’d consider heading overseas for Iron Ore exposure when we have three of the world’s top four producers listed locally. This is fair; however, Vale’s combination of high-grade operations, trading at a material discount to our own miners, makes is worthy of consideration, and at the very least, provides a good comparable when thinking about BHP, RIO & FMG.