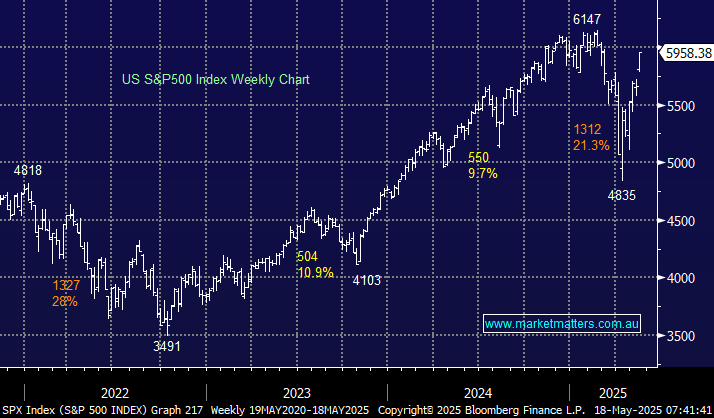

The panic on Wall Street has vanished almost as quickly as it arrived. It will be fascinating to watch the S&P futures this morning as traders decide whether to again “buy the dip.” Interestingly, short interest in the world’s biggest exchange-traded fund tracking the Nasdaq 100 has grown and now sits almost three times its February low. However, while people remain increasingly comfortable being short stocks, it’s a contrarian bullish indicator to MM.

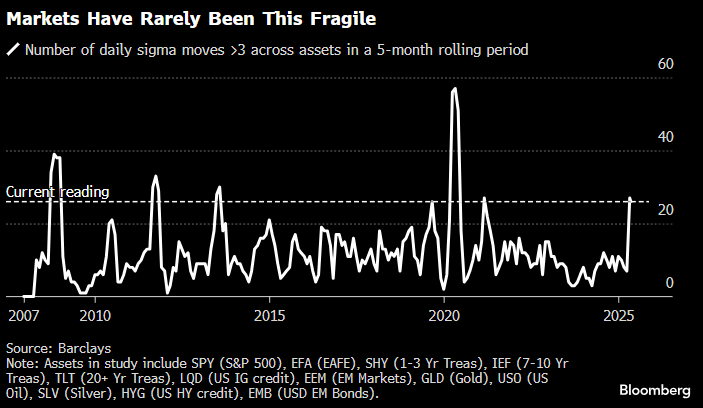

The scars of April are still fresh, keeping timid buyers on the sidelines as “Fear of Missing Out” slowly gathers momentum. In corporate bonds, bearish positioning is rising, with shorts on BlackRock’s high-yield ETF reaching a six-month high. One reason for the lingering caution is illustrated by a Barclays model that tracks extreme price moves in everything from stocks and Treasuries to gold and high-yield debt – its nudging extreme levels bar COVID. Last week, the S&P 500 jumped 5%, Bitcoin touched $105,000, and the Cboe Volatility Index dropped below the widely watched level of 20. A basket of the most-shorted stocks surged 8%, delivering one of the harshest blows to bearish investors in years. The Nasdaq 100 is back in bull market territory after a temporary truce in the US-China trade war—it is not quiet out there!

The S&P 500 has just enjoyed its 2nd best week of 2025 yet tariff news dominates the press. Hopes that Donald Trump’s tariff war is cooling drove stocks higher, with the S&P 500 rising for a fifth straight session despite a soft reading on consumer sentiment. Over the week, the S&P 500 rose ~5%, with signs that investors are returning to US equities; fund managers added about $20 billion to American stock funds in the past week, the first inflow to the region in more than a month, according to data cited by Bank of America. If US stocks can hold together following the debt downgrade, they could be trading at fresh highs in a matter of weeks – we believe the S&P 500 will dip early this week primarily because of how strongly it’s rallied, not because of the Moody’s move itself.

- We are looking for fresh all-time highs from US stocks in the coming months, but following Moody’s move, the week is likely to start slightly rocky.