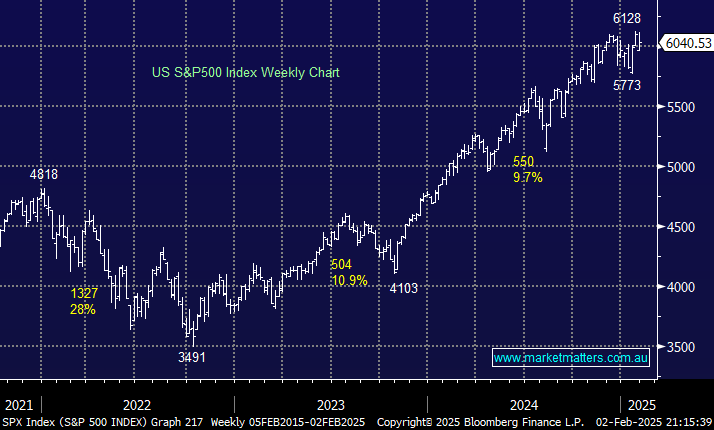

US stocks wobbled on Friday night with the small caps and Dow the weakest, although both declined less than 1%. Volatility is on the menu this week as earnings season ramps up another notch to start February, forcing investors to wade through a plethora of quarterly results amid ongoing policy uncertainty that promises upheaval for an already choppy stock market. The January jobs report is also due out Friday. Next week will be the busiest stretch for US fourth-quarter earnings – more than 120 S&P 500 companies are scheduled to release results, so far, it’s been a good season. More than 77% of the 180 S&P 500 companies already reported have beaten expectations.

The increasingly optimistic expectations around earnings, when investors are already monitoring White House updates on tariffs, combined with deciphering the future of AI after the debut of DeepSeek equals uncertainty, the market’s nemesis. However, as we’ve alluded to previously, we like the idea of buying a pullback in a market that is delivering on earnings, especially if we see a broad pullback that drags down the higher quality stocks in its wake.

- We can see the S&P500 extending Friday’s sell-off back towards the 5600/5800 levels.