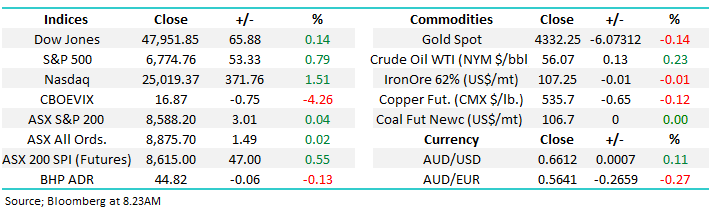

Investors face yet another bumpy start to the trading week, although attention is focused on mounting concern over US debt, which is driving long-dated bond yields higher. However, when we stand back and look at the US 30s, they have been trading between 4% and 5% since mid-2023. Although Trump 2.0 is understandably pushing yields to the top end of this trading band, we don’t believe it’s going to propel them to a new level of equilibrium unless the $US unwinds dramatically on the downside.

- We can see the US 30’s continuing their sideways dance around the 5% level until we get more economic clarity.