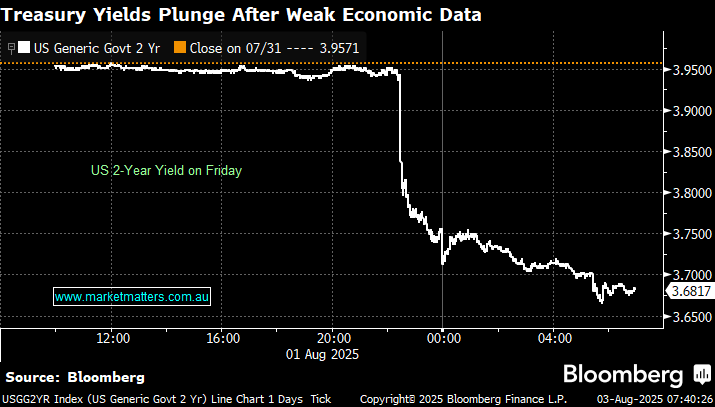

In simple terms, we believe Friday’s data has, in all likelihood, moved the proverbial goal posts after the latest employment report showed the steepest downward revisions to US jobs growth since the pandemic, offering a dramatically different picture of the labour market in recent months. President Donald Trump was quick to seize on the revisions, calling them a “major mistake” in the same social media post that also said he’s firing BLS Commissioner Erika McEntarfer. We believe Friday’s weak jobs report shows employers sitting on the sidelines amid elevated macro uncertainty. The rally in bonds/drop in yields was instantaneous following the data surprise.

The short-dated US 2-year bond yields are still trading well above their 2025 lows but we believe it’s a matter of when, not if, they test under 3.5%. The uncertainty of tariffs is taking its toll on labour markets and if we see further signs this is spreading through the US and global economy Fridays move is likely to gather momentum.

- We believe the US 2’s can test 3% in the coming months, which should be supportive of rate-sensitive stocks.