A faction of Fed policymakers have stepped up warnings that inflation progress could slow or stall, casting doubt over the prospects for another interest-rate cut in December showing the deepening divide at the central bank. Officials broadly agree the labour market has cooled, but are split over whether the slowdown will intensify. And while one group is sanguine about price pressures, others are warning interest rates at the current level are barely restraining the economy and see further cuts putting progress on inflation at risk. This public sparring is unusual but not surprising as It reflects the difficulty of reading the economy right now, and the predicament facing Fed Chair Jerome Powell, who has the task of forging consensus on the direction of monetary policy. The rate-cut sceptics have two core two ideas:

- First, they argue that a slowdown in jobs growth may reflect changes in immigration policy and technology, rather than a serious deterioration in demand for workers that threatens a sharp rise in unemployment.

- Second, they point to inflation risks that include, but go beyond, tariffs — as well as resilience in overall consumer demand. They also note that inflation has run above-target for several years, undermining the Fed’s credibility.

Powell has acknowledged “strongly differing views” among officials about the December rate decision, but has generally characterised various opinions as an encouraged part of deliberations. A lack of economic data, courtesy of the US government shutdown, hasn’t helped.

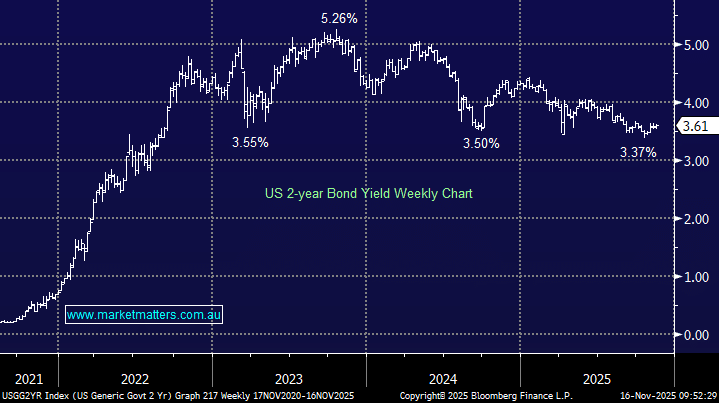

- We can see the US 2s rotating between 3.5% and 4% until the economic picture clears.