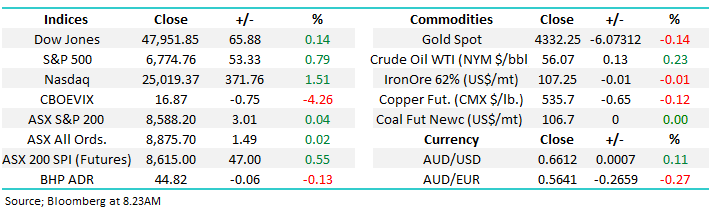

Traders are betting that the Fed will cut the rate by a total of 1.2% over the next 12 months. That would bring benchmark borrowing costs to 2.9%, below the 3% mark, largely considered a neutral level that neither stimulates nor restricts the economy. Friday’s data confirms that US inflation remains sticky, but is gradually fading, reinforcing the case for multiple Fed rate cuts into next year, in turn, giving the green light to stocks. The pass-through of higher tariffs to consumers has continued to undershoot expectations, which in turn has opened the door for the Fed to lower rates to support the cooling labour market. Also, separate data last week showed US consumer sentiment fell in October to a five-month low, as worries persisted about stubbornly high prices and the impact on finances, giving the Fed a pass to cut rates through the end of 2025.

However, the impact on US short-term bond yields was minimal, as the 2s drifted below 3.5% illustrating the bond market has been looking for 4, and probably 5, Fed cuts over the next year. To us this illustrates how stocks are grabbing at any bullish news, even if it’s been priced into credit markets for many months, reinforcing the current bull market in stocks.

- We are looking for the US 2s to drift down towards 3% through 2026, supporting stocks along the way.