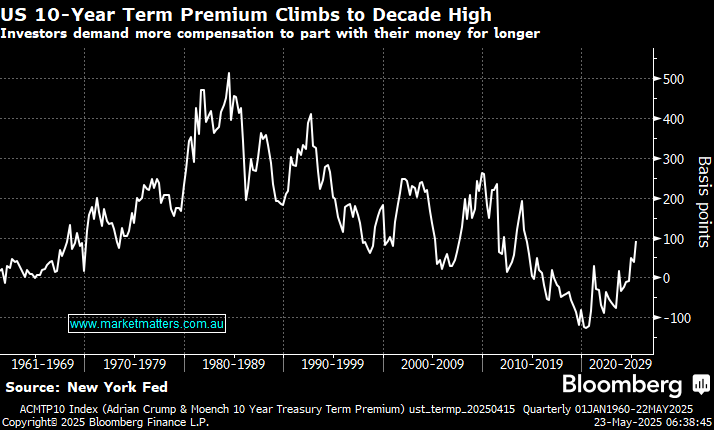

The recent selling in Treasuries reflects worries about the US’s surging debt load. This anxiety was amplified recently after Moody’s downgraded the nation as a top-notch sovereign credit, joining the likes of Fitch who made the same move in 2023. Embedded in the market is an increase in the premium investors demand to shoulder the risk of owning longer-term US debt. According to Goldman’s trading desk, the recent move in Treasuries neared the pain threshold for the equity market. Based on its calculations, stocks come under pressure when the 10-year bond yield moves higher by two standard deviations within one month. In simple terms, Trump 2.0 is facing its next hurdle, convincing financial markets that its tax package isn’t going to burden the US with unsustainable debt as DOGE struggles to reach it’s cost reduction targets (i.e. remember DOGE, no longer in the headlines!)

- We see no reason for the US 10s to break out of their 3.25-5% trading range, which has held for well over two years.