US consumers are growing tired, inflation-adjusted consumer spending dropped last month by the most since January. Americans also stepped back from the housing market as new-home sales slid by the most in three years. The latest figures suggest sluggish household demand, especially for services, extended into May after the weakest quarter for personal consumption since the onset of the pandemic. We also saw new-home sales down 13.7% in May, the most in almost three years, as rampant incentives from builders fell short of alleviating affordability constraints. The latest results show homebuilders are sitting on rising inventories amid mounting economic challenges, including mortgage rates stuck near 7%, higher materials costs due to tariffs and a slowing labour market – an unhealthy mix.

At the same time, the Fed indicated they’re in no rush to lower interest rates. Consumer spending declined in May by the most since the start of the year, suggesting the elevated uncertainty around the Trump administration’s economic policies is starting to show up in data i.e. due to the lag effect. A flurry of Fed officials, including Jerome Powell, made clear they’ll need a few more months to gain confidence that tariff-driven price hikes won’t persistently raise inflation. Credit markets are listening to the data, not the Fed, with three rate cuts priced in by January.

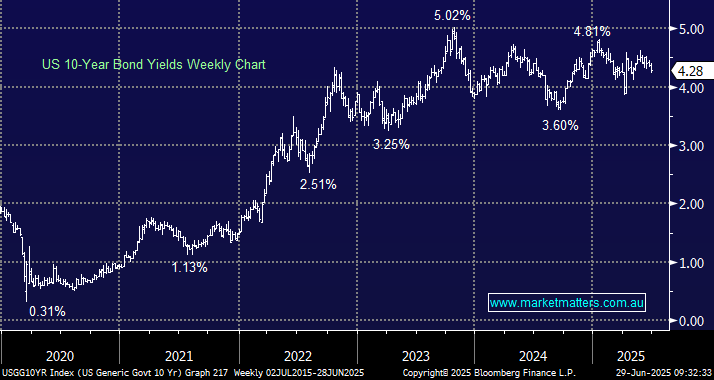

- We can see the US 10s continuing to rotate around 4%, as they have for the last few years, with a downside bias.