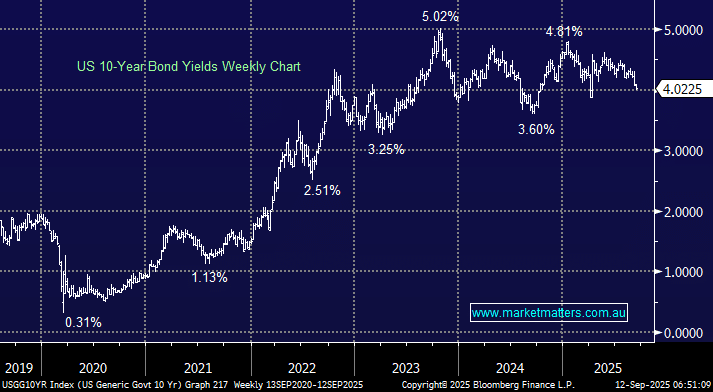

After weighing on stock market sentiment a few months ago long-dated bond yields are now offering support to equities that are currently viewing the economic backdrop through rose-coloured glasses. Tightness in the employment market is easing and we’re seeing no signs of a reacceleration in inflation, meaning rate cuts are almost a certainty next week – a backdrop that is bullish for stocks. Futures markets are pricing in two and probably three rate cuts before Christmas, plus an additional three more into mid-2026, a hefty six 0.25% rate cuts in total. While we believe this is the best case scenario for stocks until it changes, stocks will be supported.

- We can see the US 10s testing last year’s 3.6% support, affording ongoing support to stocks.