This morning, we examined UNH after its quarterly revenue beat expectations overnight, helping the stock jump over +5%. This is an impressive performance, considering the business is still dealing with the cyberattack on its subsidiary Change Healthcare. UNH reported revenue of revenue growth of 8.6% on the same period last year while the company’s adjusted earnings of $7.16 per share was a decent beat of the $6.61 expected by analysts, according to LSEG. UNH said the total impact from the cyberattack in the first quarter was 74 cents per share, and it expects the full-year impact to be between $1.15 and $1.35 per share; this has become a huge issue for companies on a global scale. UnitedHealth is made up of two major business units: Optum and UnitedHealthcare.

Optum offers a range of pharmacy services that provide medical care for around 103 million consumers. Optum reported $61.1 billion in revenue for the first quarter, up from $54.1 billion in the same period last year. Revenue growth was led by its patient care and pharmacy arms due to “strong expansion” in the number of customers. In 2022, Optum completed a $13 billion merger with Change Healthcare, which offers tools for payment and revenue cycle management. Change Healthcare processes more than 15 billion billing transactions annually, with around one-third of patient records passing through the system.

UnitedHealthcare provides insurance coverage and benefits services to millions of Americans. UnitedHealthcare reported revenue of $75.4 billion for the first quarter, up from $70.5 billion a year ago. The company said the growth was driven by an increase in the number of people that UnitedHealthcare serves in the US as the total number of domestic consumers served grew by 2 million during the first quarter.

- During the company’s earnings call, CFO John Rex said UnitedHealthcare is “pretty much back to normal in terms of claim submission activity” in the wake of the cyberattack.

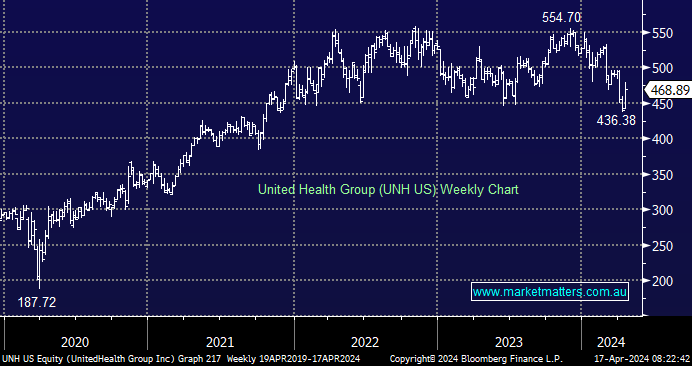

- With the Change Healthcare merger and cyberattack largely in the rearview mirror, we like UNH’s risk/reward ratio around current levels – the stock has been consolidating between $US450 and $US550 for over two years.