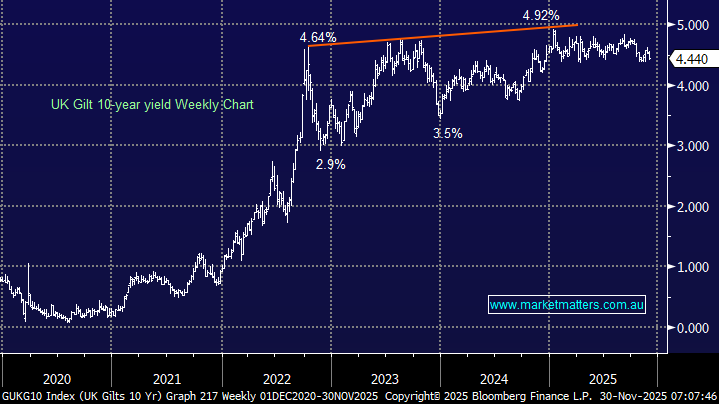

Last week, Chancellor of the Exchequer Rachel Reeves unveiled £26 billion ($34 billion) in tax increases in a budget designed to satisfy both bond markets and restive Labour backbenchers. Early market and political reactions suggested she struck the balance: UK gilt yields fell, while left-wing MPs praised the budget’s shift in the tax burden. The Office for Budget Responsibility judged that, taken together, the budget’s major tax-and-spend measures would have “no significant impact on output by 2030.” That outcome may offer some comfort to the Chancellor, given concerns that higher taxes could weigh on activity. Still, it does little to advance what the government has described as its top priority: lifting the UK’s long-term growth rate.

- Credit markets are looking for 2 or 3 rate cuts in 2026, we feel the economy and government policies are finely balanced with a move by the 10s 5% or below 4% both easy to envisage.