In October, Swiss bank UBS smashed third-quarter expectations with $US1.4 billion in profit, which was about double expectations, though there are a few swings and roundabouts in thinking about these numbers given the accounting complexity following the takeover of stricken Credit Suisse.

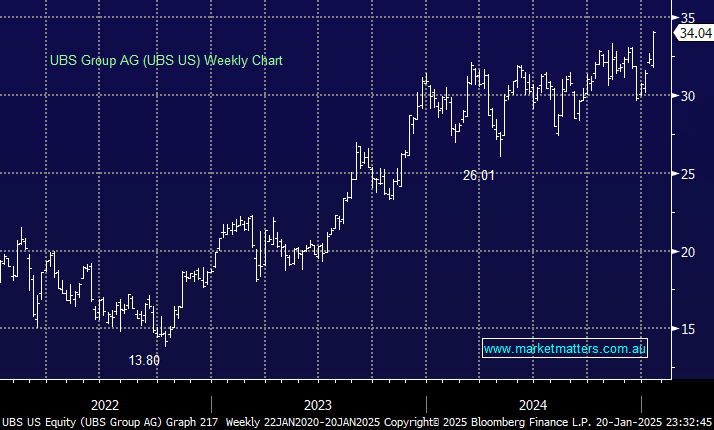

That said, The Swiss banking titan has successfully completed its first wave of client migrations and group revenue of $US12.33 billion was very good. The stock has surged to fresh all-time highs in 2025, aided by a booming Investment Banking division that shone in the third quarter, with the branch’s net income up 36% year-on-year.

Scale matters in banking and our original thesis for buying UBS was the acquisition of Credit Suisse and the step change this would bring to the UBS business globally. Integration of any acquisition is complex, but particularly so in banking and under stressed conditions with short time frames as was the case in this instance, so tracking progress on the integration has been our main priority when assessing our position in UBS, and it looks to be going well.

From a risk/reward perspective, we like UBS moving forward but wouldn’t add to our position above $US30. We prefer US peers like Citi, to increase our exposure to overseas banks.

- We have held UBS in our International Equities Portfolio since August 2023.