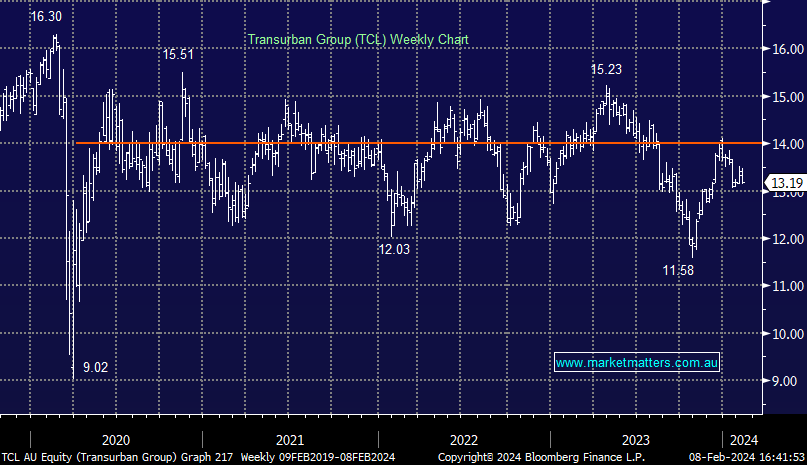

TCL -0.98%: the toll road company was out with 1H numbers today showing a largely in line result, though the all-important dividend was pre-announced. Daily traffic numbers were slightly disappointing, only growing 2.1% though Revenue was up 6% while EBITDA grew 7.5% to $1.3b, only the smallest of beats to consensus expectations. They’ll pay a 30cps interim dividend and left FY guidance for 62c (32c 2H) unchanged however the market was hoping for a small upgrade here. The market was keen to hear about growth plans following the ACCC’s decision to block the acquisition of the only other Australian toll road operator, Horizon Roads which runs East Link in Melbourne, last year. Hile no new opportunities were presented, the company did flag North America as a growth avenue outside of its current asset base.

scroll

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM remains bullish TCL

Add To Hit List

Related Q&A

Is TCL a utility or an industrial ?

Our opinion on TCL and MQG at their current prices?

Relevant suggested news and content from the site

Video

WATCH

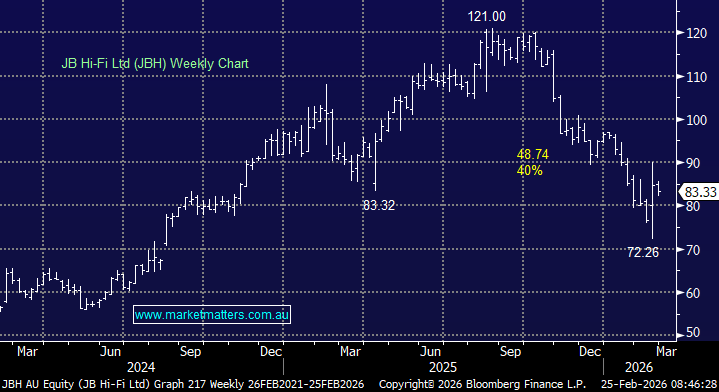

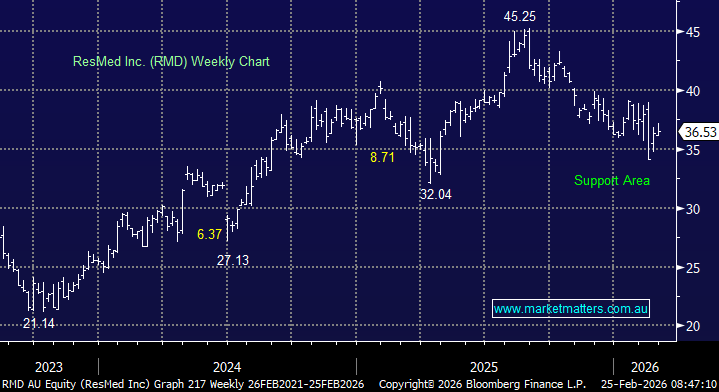

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.