TCL gained +1.7% on Thursday, posting fresh 16-month highs after the toll road operator maintained its dividend guidance and announced an expected $50mn in annualised cost saving – the laying off of 300 workers following a workforce review caught the headlines. The stock has a steady 4.4% yield, which should be very supportive with the RBA Cash Rate forecast to test 3% in 2025.

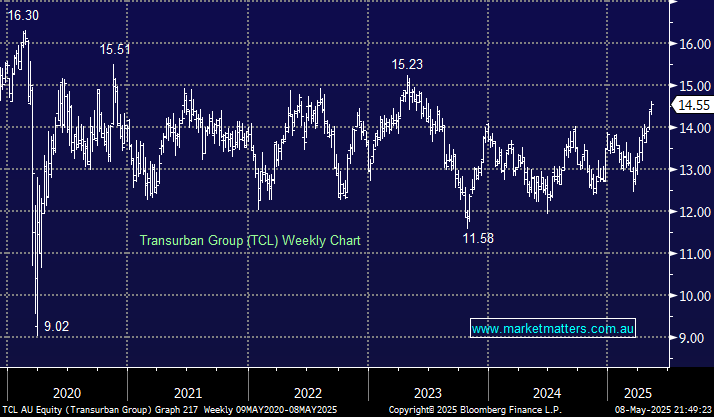

- We are initially looking for a test of the $15 area for TCL, but it’s approaching the top end of its 4-year trading range.