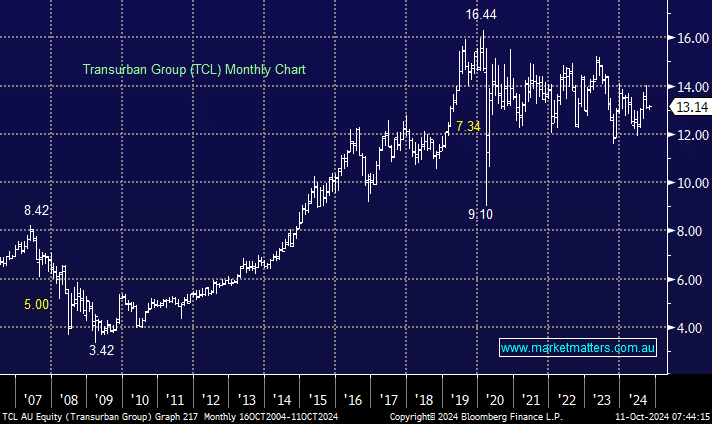

In FY24, toll road operator TCL grew traffic by +1.7%, and underlying free cash flow (FCF) by +8.2%. This was a solid result, but traffic volumes remain on the softer side of expectations, and growth in Westconnex is still proving difficult. The stock’s forecast yield ~ of 4.7% isn’t compelling, with term deposits still at similar levels. We believe a combination of improving Australian traffic flows, further margin expansion, lower interest rates and more success in future deals will help the market rebuild confidence in the company’s growth outlook, but when is the million dollar question?

- We see no reason to buy TCL at this stage, seeing better alternatives for income elsewhere – it will come good, but there’s no hurry.