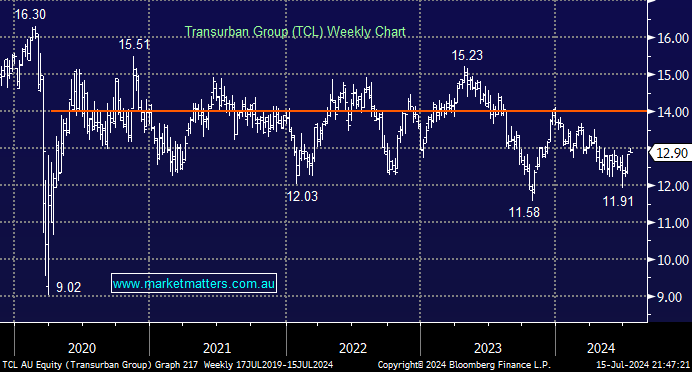

We discussed TCL in detail in April, and not a great deal has changed in the past few months, including the share price, which is up just 1c, although it did pay a 32c part franked dividend. Overall, we liked a few things from Mays Investors Day, including traffic demand supported by macroeconomic forecasts such as population growth, reducing CAPEX (costs), and the West Gate Tunnel project on track for late 2025 completion.

- We like TCL as a conservative income play, although its forecast yield of ~4.8% is well below that of APA.