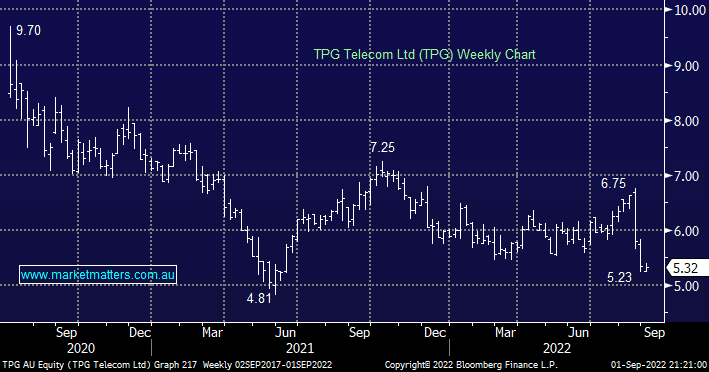

The only hand grenade to land in the MM Flagship Growth Portfolio over the reporting season was TPG which is still sitting over 20% below August’s high having turned a paper profit into a loss in the process.

- TPG’s revenue of $2.19bn was around 2% below expectations while EBITDA was a 3% miss (excluding restructuring costs relating to the Vodafone merger).

- The miss was a result of lower Average Revenue Per User (ARPU) and higher costs, the latter being a bane for a number of local companies/industries.

- The companies paying a 9cps fully franked dividend on the 13th which is attractive considering the stock feels a little overcooked on the downside.

- Arguably the largest issue for the share price was the lack of guidance for the 2nd half, we all know the market hates uncertainty.

The question is “what now” as we’ve seen companies that disappoint with their earnings generally suffer underperformance for months:

- We believe TPG has found some support after its painful drop and can see it outperform into this month’s dividend.

- However if we see a number of our flagged target stocks reach our “buy zone” and TPG is holding we definitely will be considering switching.