TPG delivered a very disappointing profit result last month and the stock has suffered accordingly, for MM turning a paper profit into a loss in one fell swoop.

- TPG’s 1H22 result was a slight miss on revenue but a meaningful 6% miss on EBITDA, or a 3% miss excl. restructuring costs.

- We remain positive about the company’s growth outlook, especially in the mobile subscriber area but this may take time to flow into share price performance.

- In a nutshell, the stocks fallen over 23% when ~10% would have felt more reasonable but the market appears to have lost confidence in what comes next.

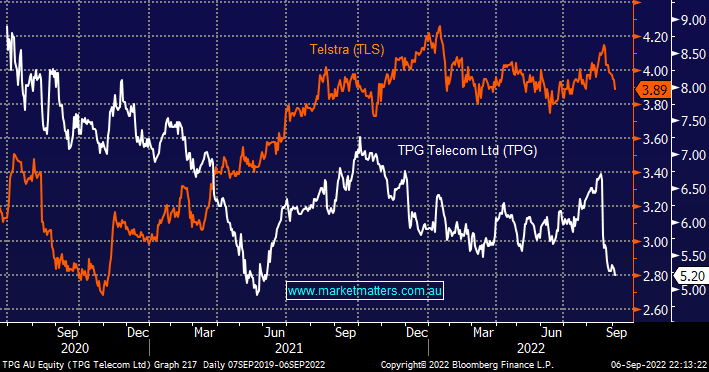

Over recent years when a company starts missing on expectations, they’ve often been thrown into the “naughty corner” from a valuation perspective until they can demonstrate that the ships been steadied. Over the same few weeks, Telstra (TLS) has slipped ~7% including paying a dividend hence clearly questioning whether this is an opportune time to switch from TPG to TLS.

- On the dividend front TLS traded ex-dividend in late August and TPG will pay a 9c fully franked dividend next week.

We reduced a number of our holdings into August’s strength, TPG may, unfortunately, become a position where we trim/cut into weakness. At this stage our 6% position in TPG feels too large and we anticipate reducing at an opportune time over the coming weeks & / or we may switch to TLS.