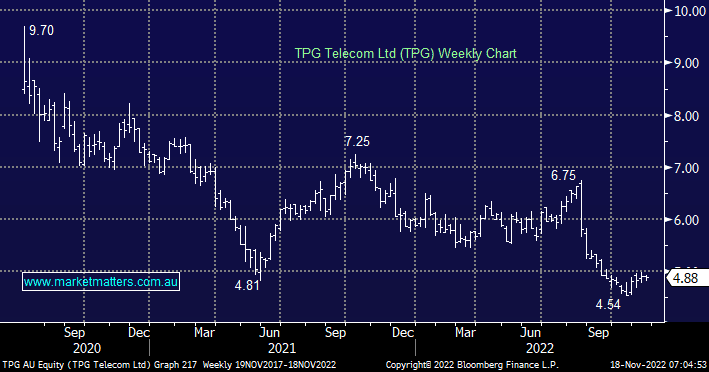

TPG was thumped in August after delivering a disappointing result and in today’s tough market the stocks showed little ability to recover. TPG is trading on 6.5x FY23e EBITDA which is at a 6% discount to TLS on 6.9x, despite offering higher free cash flow yields at 9.3% versus TLS at 5.4%. TPG is also forecast to pay a similar dividend yield in FY24e of ~5.3%, with scope for an upside surprise. We can see TPG has the ability to gain incremental share in mobiles but the stock remains in the naughty corner as far as investors are concerned.

- We want to see some operational turnaround at TPG but it does scan fairly cheaply below $5 and it is starting to “feel” like a recovery story.