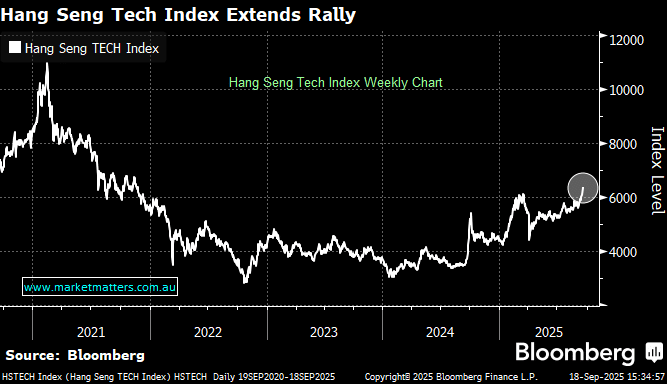

Chinese tech stocks posted a near four-year high on Thursday as AI-fuelled buying and a regulatory ban on an Nvidia Corp. chip boosted prospects for domestic rivals. The Hang Seng Tech Index rose as much as 2% on Thursday, before fading into the close, building on Wednesday’s 4.2% rally that marked its highest close since November 2021. Gains followed a Chinese regulator’s order to halt imports for Nvidia’s RTX Pro 6000D, seen as a boost for domestic chipmakers. Chinese chipmaker SMIC contributed the most to the tech index’s advance, with shares surging as much as 8.3% in Hong Kong. Hua Hong Semiconductor Ltd. jumped as much as 13%. Shares of Alibaba Group Holding Ltd. and Baidu Inc., which are developing their homegrown alternatives to foreign chips, also rose.

- We continue to like the Chinese tech sector as Beijing strives to develop homegrown chips in the face of US sanctions – Trump et al could end up shooting themselves in the foot on this one.

The Nvidia chip ban presents a substantial tailwind for SMIC’s growth outlook, while Huawei Technologies Co. also unveiled on Thursday its latest solution to bundle more AI chips together and boost computing power in a bid to challenge Nvidia’s technology. Meanwhile, Chinese tech stocks as a group offer attractive valuations compared to their US peers, which should support the market in dips. With Beijing taking the AI revolution as seriously as the likes of Meta and Google, there’s no reason not to expect some revolutionary technology to come from the world’s second-largest economy.

- Chinese school kids are now receiving mandatory AI education, with students as young as six learning basic AI literacy.

- The school curriculum already has a mapped-out pathway for AI from the age of 6 to the end of high school.